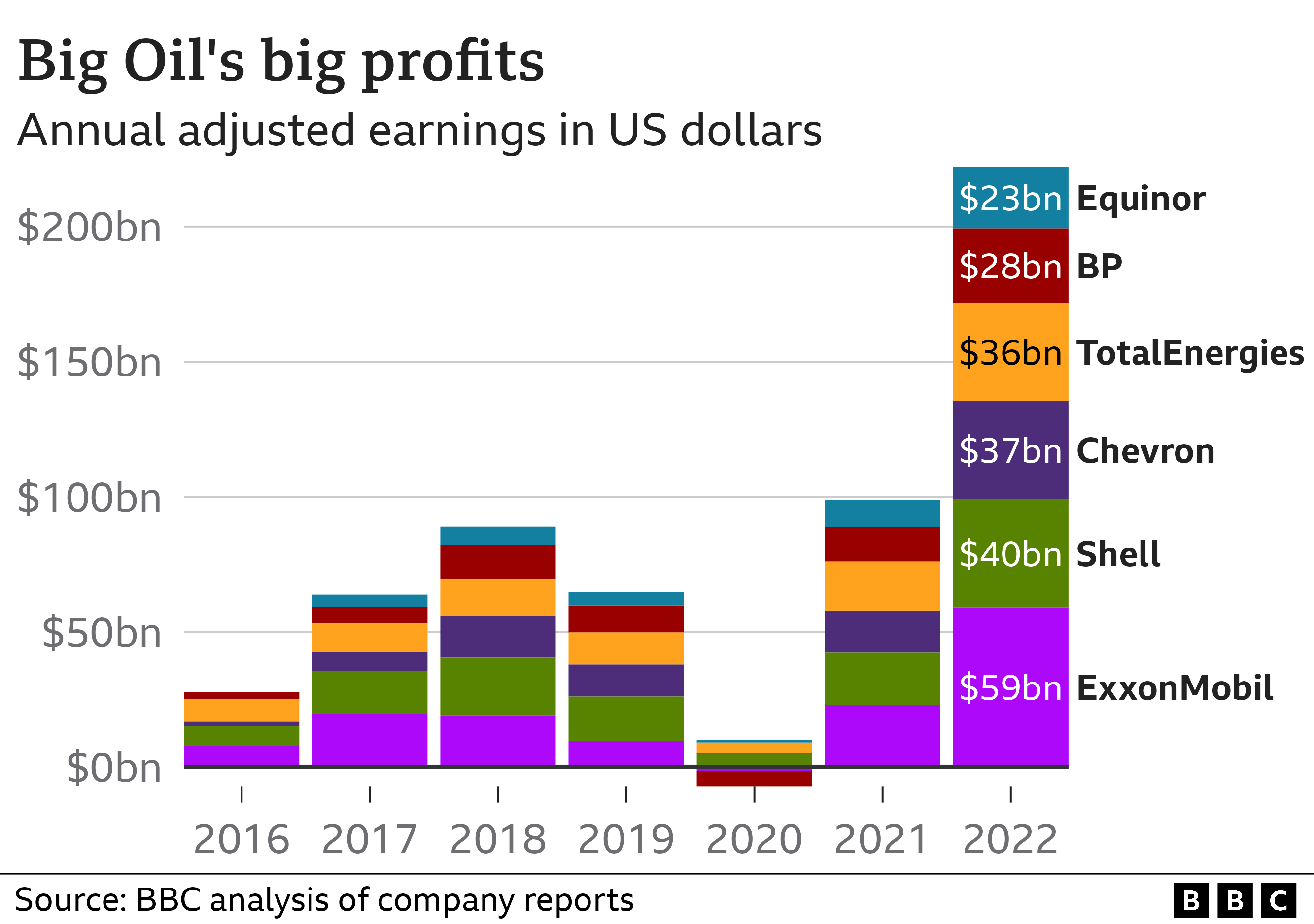

The big oil companies – from the UK-based BP and Shell to international giants such as ExxonMobil and Norway’s Equinor – have been announcing astonishing profit figures.

They are all benefitting from the surging price of oil and gas following the invasion of Ukraine.

While they rake in the profits, people around the world are struggling to pay their energy bills and fill up their cars – leading to calls for higher taxes on these companies.

So how are they making so much money, and should the government step in to stop them?

Why has the oil price soared?

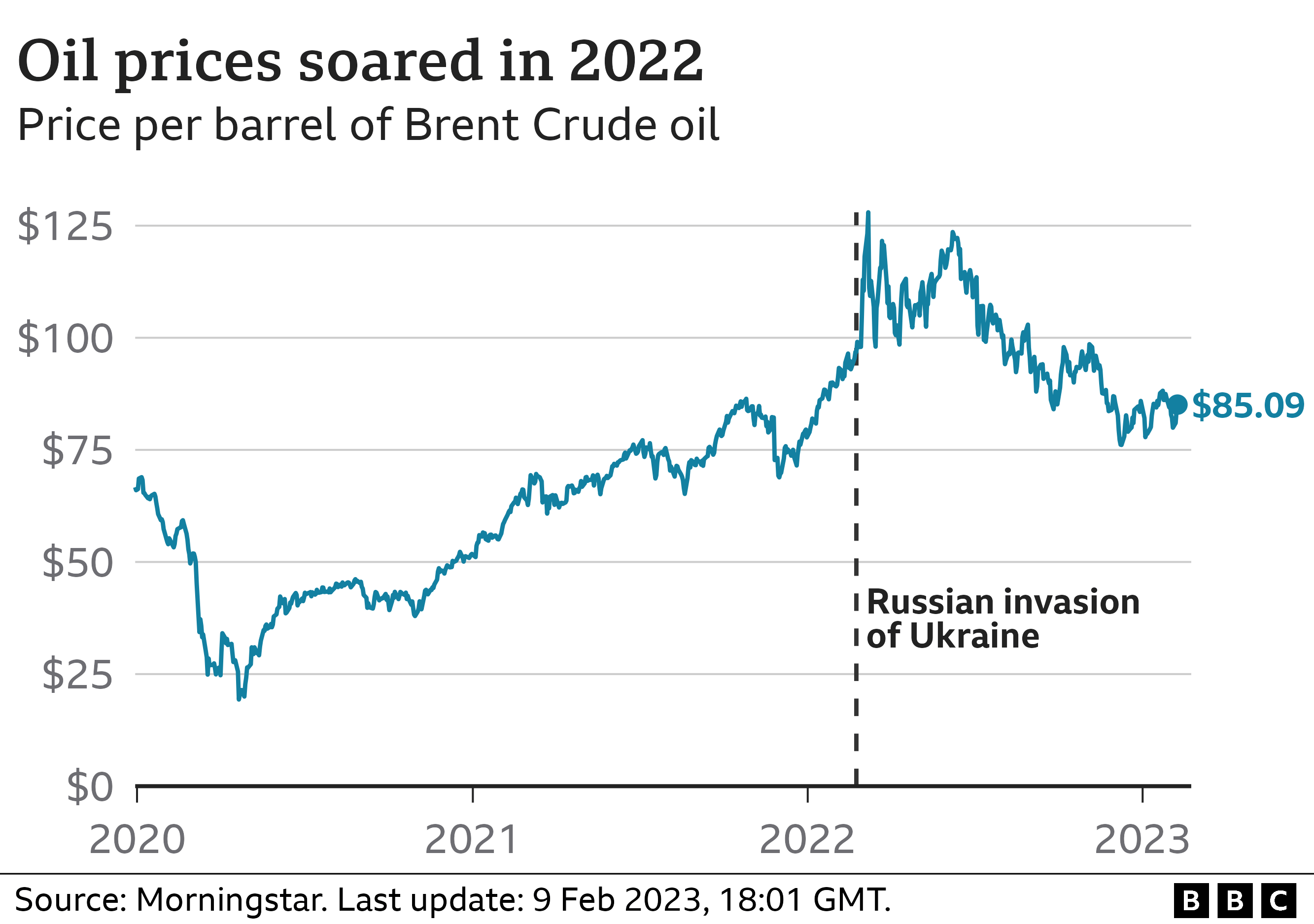

Oil and gas are traded around the world, and if supplies are short and demand high, sellers can charge more, and the price goes up.

Before the Ukraine war, Russia was the world’s largest exporter of oil and natural gas.

A lot of the money that people paid to buy that oil and gas went to the Russian government – those exports made up 45% of the Russian government budget in 2021.

After the invasion, Western countries, including the UK and EU, tried to stop (or at least massively reduce) their energy imports from Russia, to avoid funding the Russian military and supporting a hostile regime.

Countries that didn’t want to buy from Russia had to pay much higher prices for oil produced elsewhere.

Oil prices had already been rising as economies reopened following Covid-19 lockdowns, and people needed more oil.

The day after the Russian invasion, the oil price went above $100 a barrel, and peaked at over $127 in March, before coming back down to around $85. Gas prices also soared after the invasion.

Oil and natural gas are crucial to almost every aspect of modern life. Oil is used to make petrol and diesel, and natural gas is used for heating and cooking.

They’re also used in agriculture, electricity generation, and other industrial processes which make everything from fertilizer to plastics.

So a sustained rise in oil and gas prices pushes up the cost of many other things we buy, driving the cost of living crisis that has gripped the UK – and other countries – in recent months.

Why do soaring prices mean more profits?

Oil companies make money by locating oil and gas reserves buried in rocks under the earth’s surface, and drilling down to release them.

The costs don’t vary that much as the price goes up or down, but the money they make from selling it does.

So when oil prices soared after the invasion of Ukraine, the money these companies made from selling oil and gas massively increased as well.

How much profit did Shell and BP make last year?

On Tuesday, BP reported record annual profits of $27.7bn (£23bn) for 2022, as it scaled back plans to reduce the amount of oil and gas it produces by 2030. Those profits were double the previous year’s figure.

In February, Shell reported its highest profits in 115 years. Profits hit $39.9bn (£32.2bn) in 2022, double the previous year’s total.

The profits they make don’t all disappear – lots of ordinary people own shares in BP, Shell, and other global oil companies. This may be via their pension funds, and they may not even be aware of it.

Some of the extra profits are paid to shareholders through higher dividends, and buying back shares (which increases the share price).

But as long as the billions roll in while customers struggle to pay their bills, the calls for higher taxes will continue.

How much tax do oil and gas producers pay?

Big oil companies made their record profits even after paying billions to governments around the world.

BP and Shell are in a complicated position because they are headquartered in the UK but produce a relatively small amount of oil and gas in UK waters. They make most of their profits from activities around the world.

Shell paid $134m (£110m) tax on its UK operations in 2022, out of a worldwide tax bill of $13bn.

BP paid $2.2bn (£1.8bn) in taxes on its UK operations, out of a global tax bill of $15bn.

How are oil firms taxed in the UK?

Oil companies already pay a tax on their profits from oil and gas production in the UK of 40% – which is higher than taxes on other companies.

But they can reduce that tax bill by deducting the cost of shutting down old oil rigs, or offsetting future investments and losses from earlier years.

In some years, BP and Shell have paid no tax on UK operations, and received payments from the UK government instead.

After the invasion of Ukraine, the government faced calls to introduce an extra “windfall tax” on energy company profits to help pay for soaring energy bills.

- What is the windfall tax and how much are oil giants paying?

This was introduced in May 2022, and increased from 25% to 35% in November. It is now expected to raise around £40bn extra from all the companies operating in UK waters between 2022 and 2028.

However, the windfall tax only applies to the profits on UK oil and gas production, which only account for a small share of some firms’ profits.

And firms can deduct more than 90% of the cost of new exploration and production from their windfall tax bills, significantly reducing what they have to pay.

The windfall tax accounted for all of Shell’s UK tax bill, and $700m (£538m) of BP’s.

They face calls to pay even more tax

Politicians, environmentalists, trade unions and poverty campaigners have attacked oil companies’ record profits, and argued for higher windfall taxes.

They say high prices are the result of something beyond the oil firm’s control – war, and that it’s not fair that oil companies are profiting from people’s suffering.

Some say higher windfall taxes are a good way for governments to raise money because they’re easy to collect and hard to avoid.

Even the former boss of Shell himself, Ben van Beurden, wondered if it was inevitable that governments would need to tax energy producers more to protect the poorest in society.

But oil firms argue that a higher windfall tax would make them less willing to invest in producing in the UK, and that they would search for oil elsewhere where taxes are lower.

Harbour Energy, which produces more oil and gas in the UK than anyone else, is cutting jobs and reconsidering its UK investments because of the windfall tax.

If the UK government decided to tax BP and Shell on their global profits more heavily, they could potentially move their headquarters out of the country – escaping the new tax, and depriving the UK of much of the revenues they currently pay.

Oil companies have to operate in a world where the price of oil can go down as well as up, with little warning. Money made in the good years helps to balance out years when oil prices are low.

Many oil companies lost billions from Russian investments last year – BP wrote off $24bn of investments in the Russian oil company Rosneft, for example.

They also have to invest billions to find new reserves of oil to keep supplies running until the world switches over to renewable sources of power.

Energy companies have a big role to play in that switch-over, too. BP and Shell invest some of the billions they make from oil and gas into renewable power such as solar and wind farms, and charging stations for electric cars.

BP boss Bernard Looney said the British company was “helping provide the energy the world needs” while investing the transition to green energy.

Shell chief executive Wael Sawan said that these are “incredibly difficult times – we are seeing inflation rampant around the world” but that Shell was playing its part by investing in renewable technologies. Its chief financial officer Sinead Gorman added that Shell had paid $13bn in taxes globally in 2022.

However, BP scaled back its plans to cut its carbon emissions this year because demand for oil and gas is so strong.

Does the energy cap reduce oil company profits?

The energy price cap was introduced in 2019 to stop companies overcharging people who didn’t shop around for cheaper deals. It targets energy suppliers, and doesn’t affect the profits of oil and gas producers.

Related Topics

- Tax

- Shell

- North Sea oil and gas

- Oil

- BP

- Natural gas

-

BP scales back climate targets as profits hit record

-

5 days ago

-

-

Shell reports highest profits in 115 years

-

2 February

-

-

Oil and gas firm blames job cuts on windfall tax

-

18 January

-