“These are my precious possessions that I’ve had to pawn because there’s no help, there’s no support.”

Clare Adams is one of a rising number of people taking out loans against things they own to pay the bills.

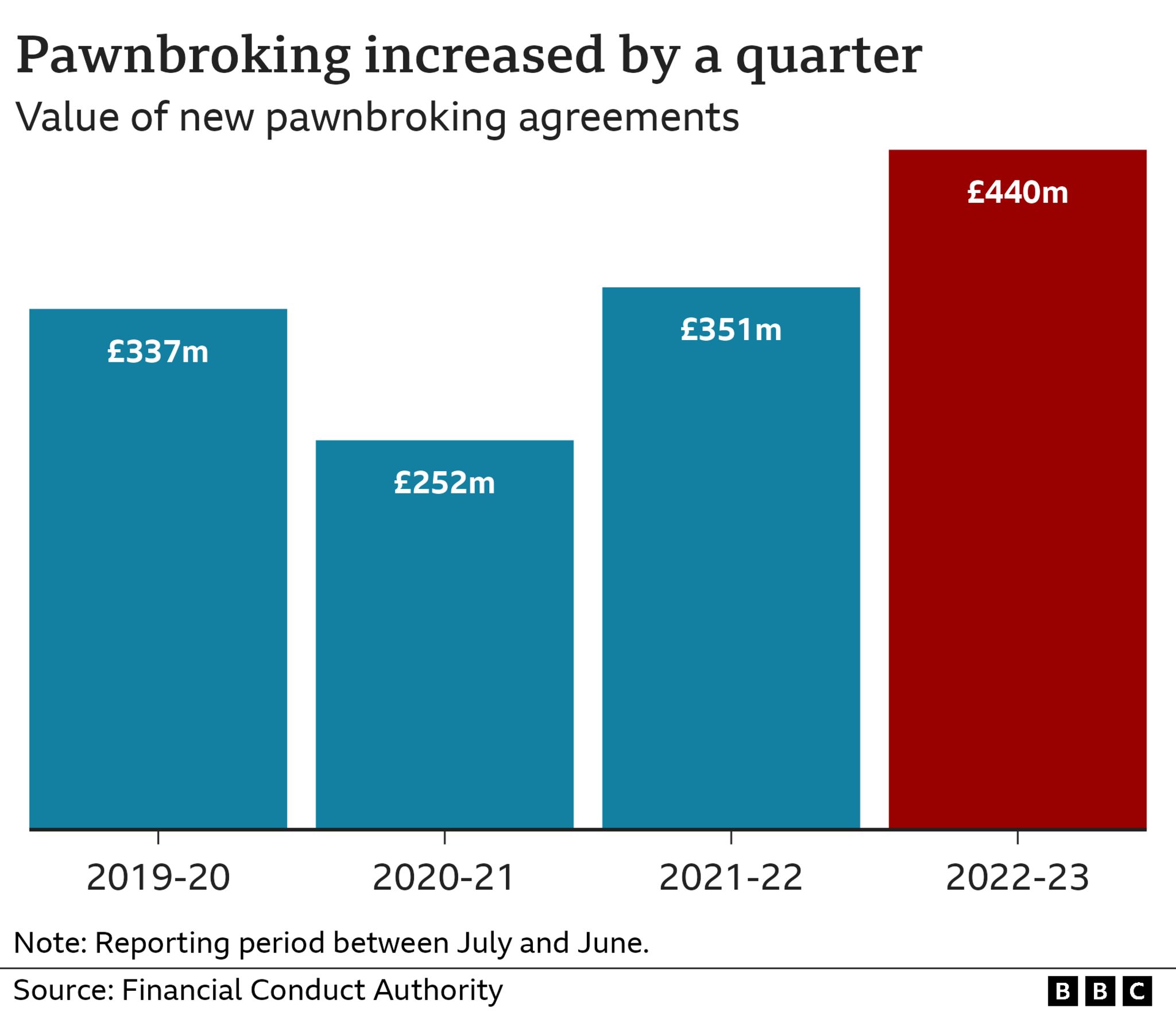

Over the last year there has been a 25% increase in the number of new loans from pawnbrokers, according to figures from the Financial Conduct Authority.

Debt Charity StepChange said the data “speaks to the scale of the cost-of-living crisis as people get desperate”.

Pawnbroking will “likely only worsen, rather than alleviate, peoples’ financial position in the long run,” warned the charity’s director of external affairs, Richard Lane.

But since a government clampdown on payday lenders, pawnbrokers are the only route for some people to get the money they need fast.

‘This is the only way I can survive’

We met Mrs Adams at Pickwick Jewellers & Pawnbrokers in South East London where she told us she felt she had no choice but to pawn her wedding, eternity and engagement rings which “mean the world” to her.

“They’ve offered me £200 so I can pay for my gas and electric and my food shopping,” she said.

She told the BBC she had previously pawned two chains and two bracelets due to rising prices.

“The cost of living is the main thing,” she said. “I can’t afford to get food, some days I don’t have anything in the house whatsoever, it’s getting really, really tough.”

- ‘We use pawnbrokers to be able to pay for food’

Mrs Adams described pawnbrokers as her “lifeline”. She said they provided a quick and easy way to get the money she needed. “If I got a loan out I’d be further and further in debt and I’d be back to square one again,” she said.

Nathan Finch, managing director of the pawnbroker we visited, said he had seen an uplift in business due to the cost of living crisis and inflation. “It’s interesting that it’s something that’s not affecting one class, we are seeing it from people who are very rich to less so,” he said.

New figures from the Financial Conduct Authority (FCA) showed £440m was loaned out to customers pawning goods in the year to June, compared with £351m the previous year.

A spokesperson said: “As people continue to face financial challenges due to the ongoing cost of living squeeze, pawnbroking may be a useful product for some to turn to.”

But they added that the FCA was working to “raise standards in the high cost credit industry, including in pawnbroking, and we’re holding firms to account for meeting them.”

How does pawnbroking work?

- Customer “pledges” an item, such as a gold ring for a set period of time, usually six months

- Pawnbroker gives 50% to 60% of the item’s value as a cash loan

- Customer pays 7% to 8% interest every month

- An item can be redeemed during the loan period by paying back the original loan and any interest up to that point

- If the customer cannot repay the loan at the end of the deal the pawnbroker sells the item and returns any surplus to the customer

More information is available from the National Pawnbrokers Association. Consumer advice on pawnbroking is available from Citizens Advice and the Money and Pensions Service.

A 2022 report suggested more than 350,000 people turned to pawnbrokers for money each year.

The National Pawnbrokers Association (NPA) said it was the only option for some people who could not get a bank loan – other than loan sharks.

But critics have said the high interest rates and low prices offered for goods mean they’re not the best option.

‘I’m left with £20 for four weeks’

Geoffrey Simmons began pawning his items six years ago “just to fill the freezer”.

Since then he has turned in around 40 items ranging from £12 to £900. He said he has had to pawn “nearly everything” to be financially stable.

Mr Simmons, who is on state pension, says after paying his bills he is left with just £20 to last him four weeks and describes pawnbrokers as a “godsend” for people his age.

Despite consistently retrieving his items before the cancellation date, he is hesitant to pursue another credit card application after previously being denied.

“I know full well I’ve got jewellery indoors that if I need to pawn, these people will help me out.”

Additional reporting by Jemma Dempsey.

Related Topics

- Money

- Personal finance

- Cost of living

-

‘My tears over pawned jewellery’

-

17 September 2019

-

-

‘We use pawnbrokers to be able to pay for food’

-

14 May 2022

-