The water regulator has said Thames Water needs to secure extra cash itself amid reports the firm lobbied to hike bills and face lower fines.

The UK’s largest water firm hopes to agree a deal with Ofwat and the government to avoid a taxpayer bailout, the Financial Times reported.

The future of Thames Water has been uncertain since fears emerged that it could collapse last June.

The company has been struggling under a huge £18bn debt pile.

Ofwat said it would not comment directly on the reports, but added: “Thames Water needs to continue to deliver on its turnaround plan to improve its operational and environmental performance.

“It is for the company to secure shareholder backing to improve its financial resilience,” a spokesman added.

Thames Water declined to comment when contacted by the BBC.

The Financial Times reported that Thames Water’s shareholders were willing to inject a further £3.25bn into the business – if they could strike a regulatory deal with Ofwat.

The newspaper said the company wanted the regulator to allow it to hike customer bills 40% by 2030 and grant it leniency on regulatory fines and around paying dividends.

Thames Water secured a £500m cash injection from its shareholders last year but its bosses have admitted the firm still faces financial troubles, including not having enough money to pay off a £190m loan due in April.

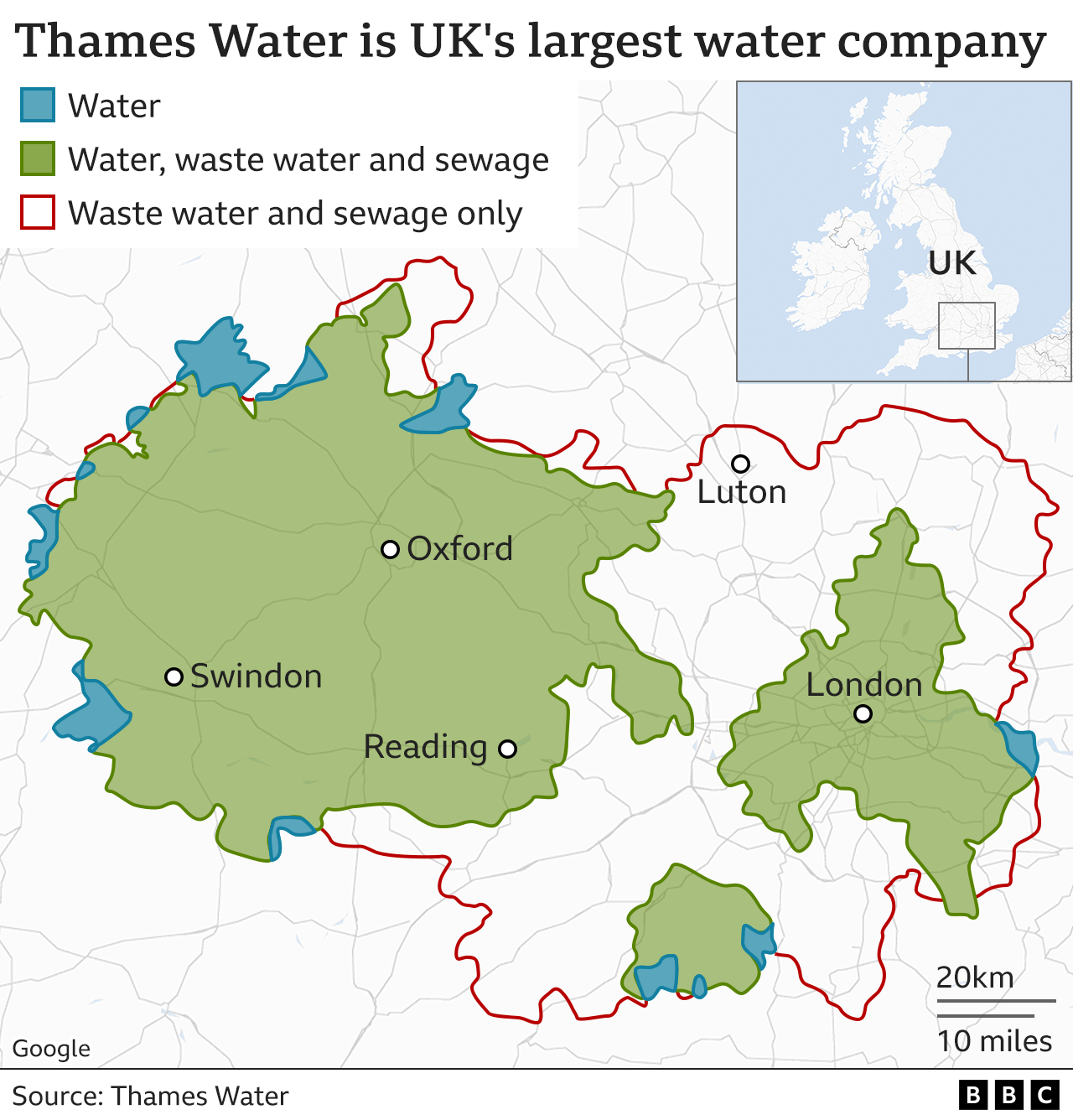

The government has previously said it is ready to take over Thames Water, which serves 15 million households, mostly across London and parts of southern England, in the event that it collapses.

But one senior government figure told the newspaper: “The collapse of Thames is the last thing we want.”

A government spokesperson said it would not comment on the “financial situation of specific companies as it would not be appropriate”, but added: “We prepare for a range of scenarios across our regulated industries – including water – as any responsible government would.”

- Thames Water says turnaround will ‘take time’

Thames Water has faced fierce criticism in recent years over sewage discharges and leaks. It leaks more water than any other water company in UK, losing the equivalent of up to 250 Olympic size swimming pools every day from its pipes.

Despite the whole industry facing criticism, water providers have forecast an above-inflation rise in average household bills in April.

The average annual water and sewerage bill is expected to rise by 6% in England and Wales, going up £27 to £473, says suppliers’ trade body Water UK.

In Scotland, water and waste charges will go up by 8.8% – a rise of £36.

Thames Water’s finances paint a bleak picture. Its latest results showed profits fell 54% in the first six months of 2023 while customer complaints rose 13%.

This month, Thames Water’s chairman Sir Adrian Montague resigned as the chair and director of the firm’s parent company Kemble Water.

The company said the move was a “personal decision”, but added the business veteran, a former chair of Aviva and Manchester Airports Group, would remain chair of Thames Water.

Sir Adrian has previously argued the best way to resolve Thames Water’s problems is to keep the company under private ownership.

Related Topics

- Companies

- Thames Water

-

Thames Water says it can’t pay back £190m loan

-

12 December 2023

-

-

Thames Water says turnaround will ‘take time’

-

5 December 2023

-