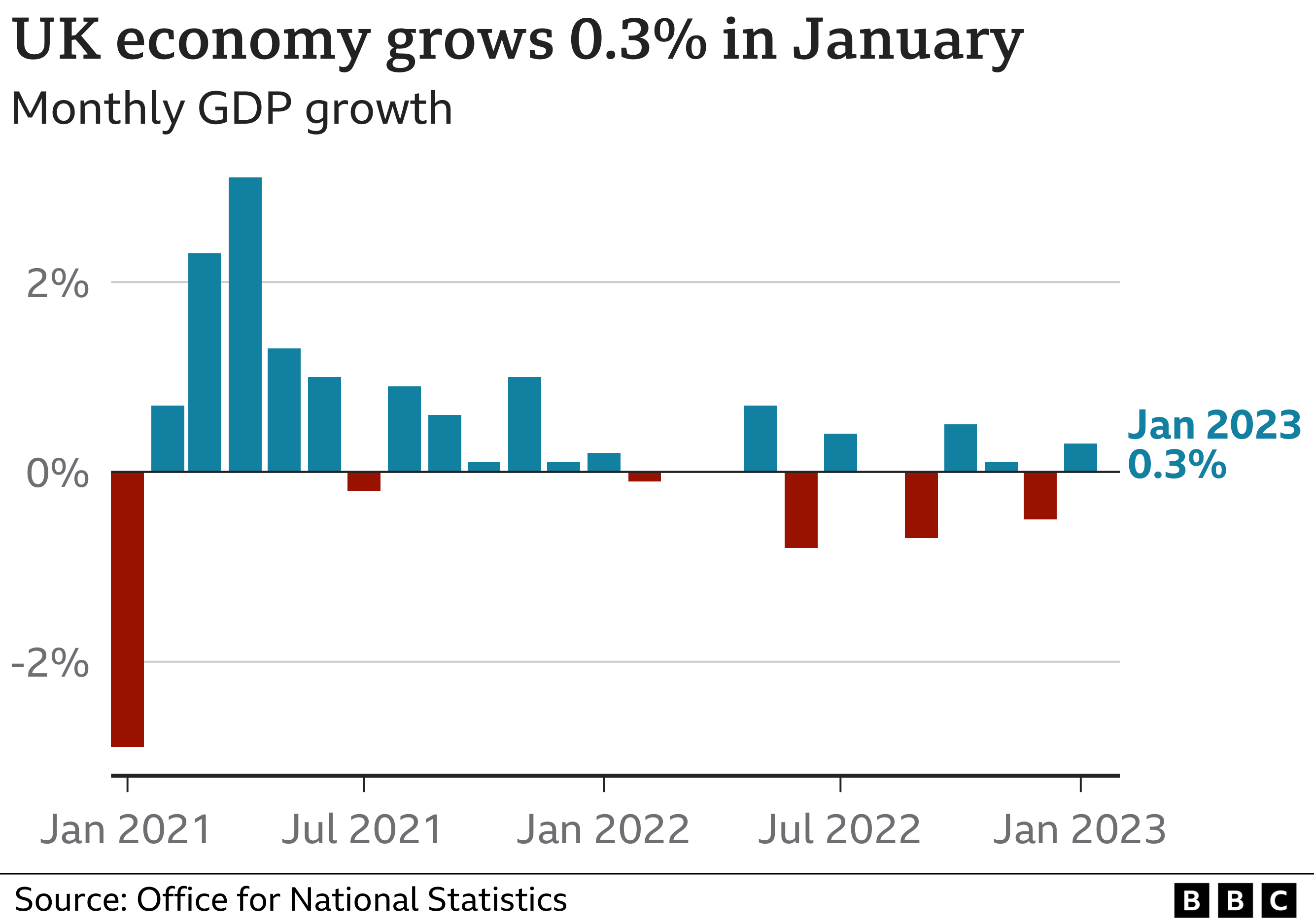

The UK economy grew by 0.3% in January as school attendance picked up and Premier League football returned after the World Cup, official figures show.

Gross domestic product (GDP) – a key measure of all the activity of firms, governments and individuals – bounced back from a sharp fall in December.

Growth was helped by a recovery in school attendance after more parents kept children home at the end of 2022.

The data comes ahead of the Budget next Wednesday.

Chancellor Jeremy Hunt will outline the government’s plan to boost UK economic growth.

While there was a rebound in the month of January, the ONS figures also showed that the economy stagnated in the November to January period compared with the previous three months.

Reacting to the latest figures, Mr Hunt said: “In the face of severe global challenges, the UK economy has proved more resilient than many expected, but there is a long way to go.”

Tina McKenzie, policy chair at the Federation of Small Businesses, said: “While January’s figures are a glimmer of hope, the flat growth over the previous three months means we’re not out of the woods yet, with tough trading conditions persisting for many small firms.”

Darren Morgan from the Office for National Statistics (ONS), which collects and publishes the data, said the UK economy had “partially bounced back” after shrinking by 0.5% in December.

“The main drivers of January’s growth were the return of children to classrooms, following unusually high absences in the run-up to Christmas, the Premier League clubs returned to a full schedule after the end of the World Cup and private health providers also had a strong month,” he said.

“Postal services also partially recovered from the effects of December’s strikes.”

- What is GDP and how does it affect me?

Economists said the rebound in January was not a surprise given a number of issues in December such as postal and rail strikes.

In education, school absences rose in December due to a spike in winter flu, Covid-19 as well as rising rates of Strep A, which can lead to scarlet fever.

The ONS said the education sector grew by 2.5% in January following a fall of 2.6% the month before. In measuring GDP, the ONS looks at areas such as teachers’ wages and how much investment has been made in schools.

Activity in arts, entertainment and recreation also grew, mainly due to football. Premier League football returned to a full schedule In January after fixtures were postponed in December for the World Cup.

However, the figures for January showed a fall in output in both the manufacturing and construction sectors.

“Looking beneath the surface, the figures suggest the economy is on weaker ground than it appears,” said Ruth Gregory, deputy chief UK economist at Capital Economics.

She added that strike action in February may have hit growth and the impact of successive interest rate rises is yet to be felt by parts of the economy.

Last month, ambulance workers, teachers, nurses and some in the rail industry walked out.

“So we doubt January’s strength will last and our hunch is that there will still be a recession,” said Ms Gregory.

However, other economists were more upbeat including Goldman Sachs, the investment bank, which predicted that the UK will avoid a downturn.

A recession is usually defined as two three-month periods in a row when the economy shrinks.

- What is a recession and how could it affect me?

The UK reported flat growth between October and December and Goldman now expects flat growth to continue in the first three months of this year.

These numbers are better than expected but the economy still has not grown over three months – and that is what is expected again between January and March.

Consumers have proven more resilient so far to the rise in energy prices and interest rates.

The Budget forecasts next week will be from a better baseline than feared last time, thanks to energy prices starting to fall.

While avoiding a formal recession entirely is now possible, for now the overall trend in the economy is flat, with tax rises and the full effect of higher interest rates to come.

The UK continues to grapple with a high rate of price rises, or inflation, leading to a squeeze on the cost of living.

While it has fallen back slightly in recent months as wholesale gas prices have ticked lower, inflation remains at its highest level for nearly four decades.

The Bank of England has raised interest rates to 4% – the highest since 2008 – in an attempt to quell inflation. While that benefits some savers, it has also raised pressures on many mortgage holders.

Related Topics

- GDP

- Economic growth

- UK economy

-

UK recession expected to be shorter and less severe

-

2 February

-

-

What is GDP and how does it affect me?

-

2 hours ago

-