One of the UK’s largest private pension funds has backed Thames Water to turnaround its finances and performance after fears the firm could collapse.

Universities Superannuation Scheme (USS), a major investor in the water firm, is the first to publicly support it as it looks to secure extra funding.

Thames Water is billions of pounds in debt and there have been calls for it to be nationalised.

USS said the firm “could benefit” from having it among its shareholders.

“We know that leakage and sewage remain major issues, but we also know there are no quick fixes where a complex network of pipes stretching for miles – some of which have been in the ground for 150 years – need to be replaced,” said USS group chief executive Bill Galvin.

Mr Galvin added improvements would “take time” and added “significant investment is needed”.

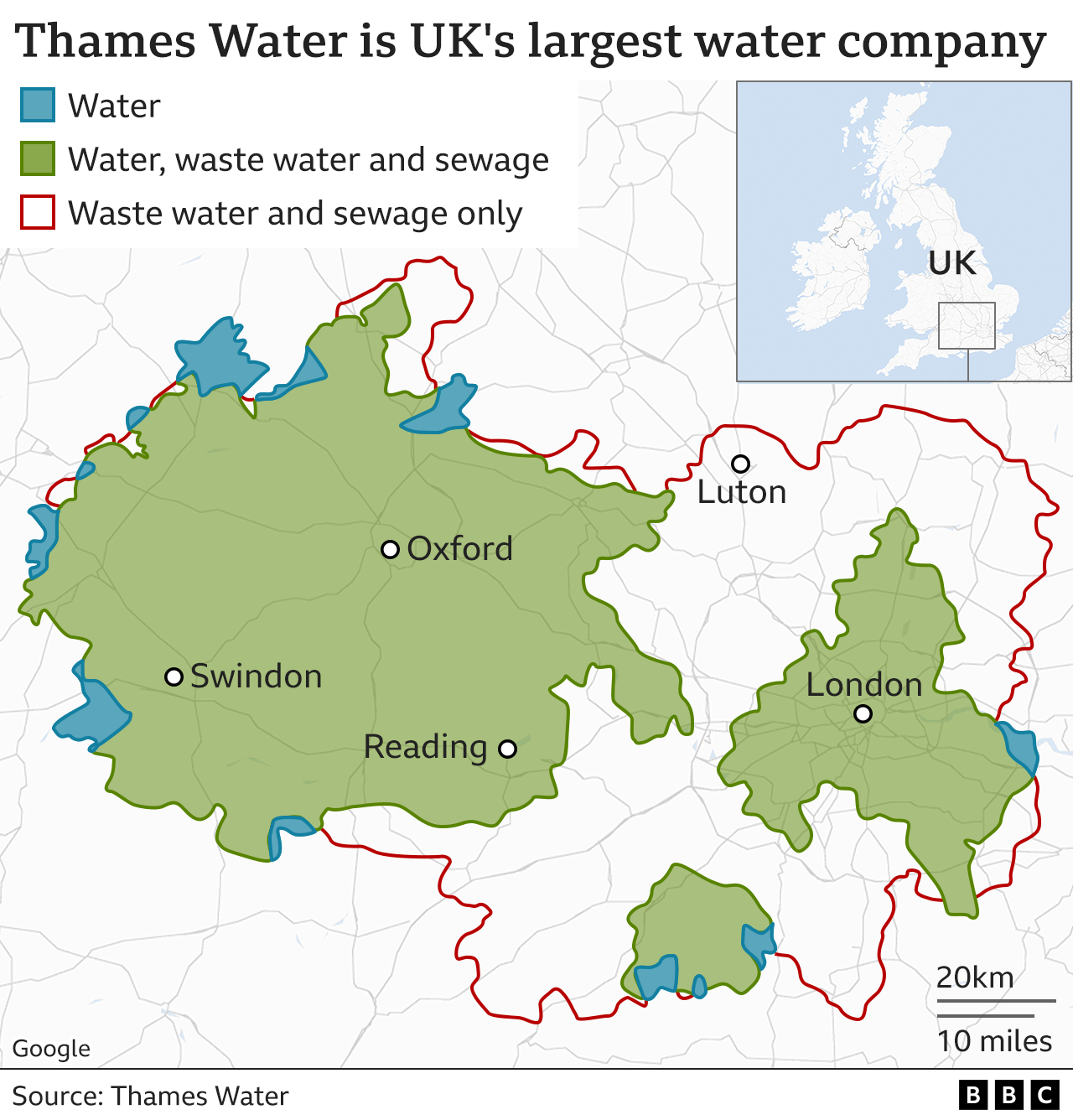

Thames Water, which serves a quarter of the UK population, has faced heavy criticism over its performance in recent years due to sewage discharges and leaks. The company leaks more water than any other water company in UK, losing the equivalent of up to 250 Olympic size swimming pools every day from its pipes.

Its chief executive, Sarah Bentley, resigned last week, weeks after she was asked to forgo her bonus over the company’s handling of sewage spills.

- Why is Thames Water in so much trouble?

- No free lunch for water nationalisation – Tory peer

Thames Water is a private company, owned by a group of investors, with the largest being the Canadian pension fund, OMERS, with 31.8%.

OMERS has declined to comment on the water firm’s current situation, but USS, a pension fund for UK academics and the second biggest investor with a 19.7% stake, is the first to announce its support.

“We have given our backing to Thames Water’s turnaround plan and Net Zero roadmap and engage with them regularly to support their long-term strategy,” Mr Galvin said in note to staff, which was first reported by the Financial Times.

“We remain of the view that, with an appropriate regulatory environment, the long-term objective of repairing important UK infrastructure and paying pensions to our members are in strong alignment.”

Thames Water said last week that it was trying to raise the cash it needs to improve.

It said it was keeping water regulator Ofwat informed on progress, and that it still had “strong” cash and borrowing reserves to draw on.

The government has said it was ready to act in a worst case scenario if Thames Water collapsed.

Regardless of what happens, water supplies will continue as normal to customers.

Last year Thames Water’s owners – including USS – pumped £500m into the business and pledged a further £1bn to help it to improve.

But the company is understood to be struggling to raise the remaining cash which it needs to service its substantial debt pile, which is around £14bn. Interest payments on more than half of its debt are linked to the rate of inflation, which has soared over the last year.

Other water firms are also facing similar pressures due to higher interest payments on their debts and rising costs including higher energy and chemical prices.

Related Topics

- Companies

- Sewage

- Thames Water

-

Thames Water customers’ bills ‘will not be affected’

-

3 days ago

-

-

No free lunch for water nationalisation – Tory peer

-

1 day ago

-

-

Why is Thames Water in so much trouble?

-

3 days ago

-

-

Thames Water in urgent talks amid collapse fears

-

3 days ago

-

-

Lib Dems unveil plan to overhaul water industry

-

4 days ago

-