The value of a home in south-east England has dropped by £15,500 over a year after the region recorded the sharpest fall in house prices in July.

Halifax, the High Street lender, said average house prices in the area, which includes the home counties, fell 3.9%.

House prices in Wales, once the beneficiary of the pandemic “boom”, also tumbled.

Overall, however, Halifax said the UK’s housing market was showing resilience, despite higher mortgage costs.

It said average prices fell by 2.4% in the year to July, valuing a typical home at £285,044. That is slower than the 2.6% decline recorded in the year to June.

Despite the falls, prices remain much higher than before the Covid pandemic.

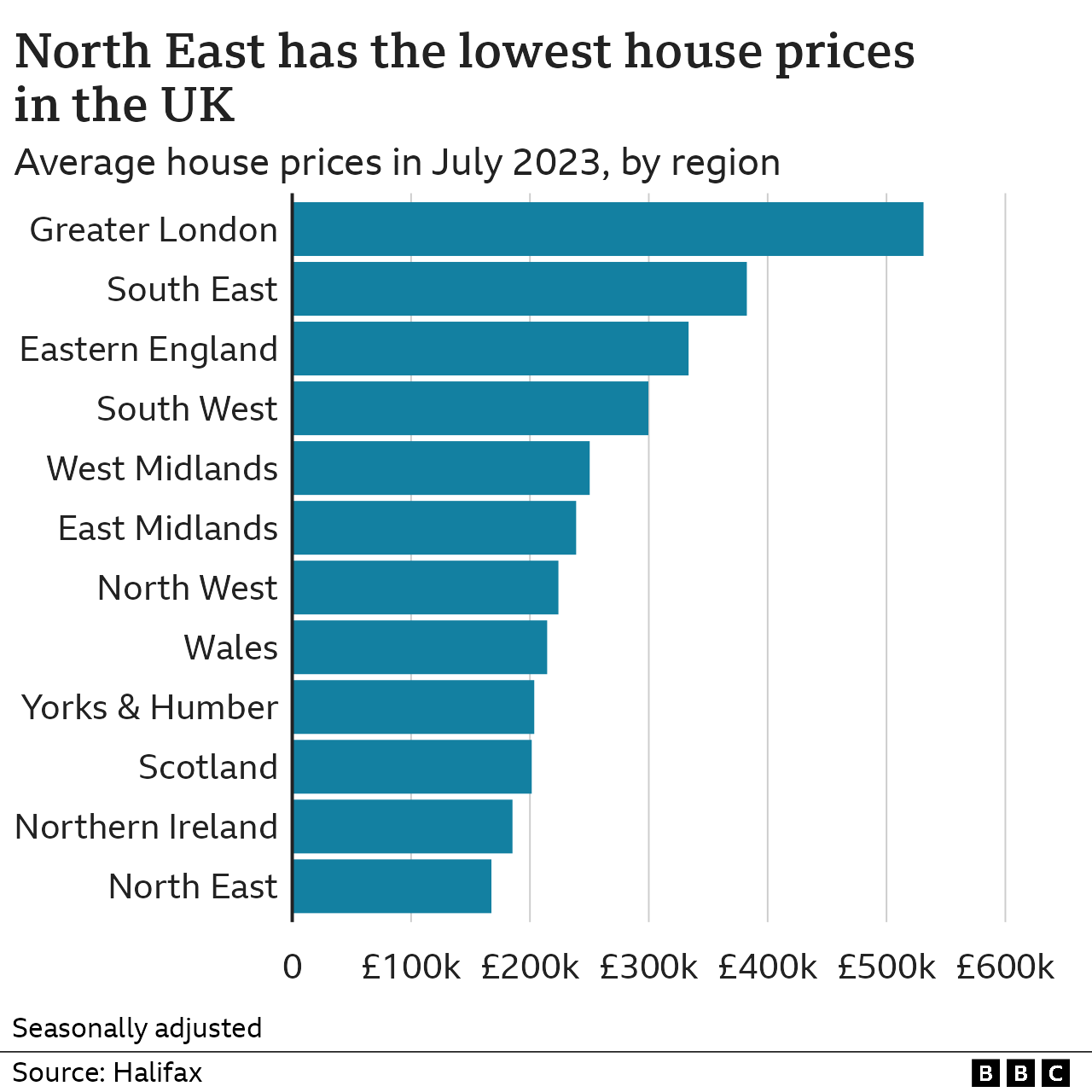

Some regions saw sharper drops than others. The value of a home in south-east England dropped to £382,489 in July.

Wales, which Halifax said had seen “some of the most rapid growth in house prices witnessed during the pandemic ‘boom'”, recorded one of the largest annual falls at 3.3% to £214,495.

Greater London also saw prices drop by 3.5% in July, but the average price is much higher at £531,141 compared to other regions.

Average house prices fell in almost all parts of the UK in July apart from in the West Midlands, where they remained unchanged.

The north east of England remains the cheapest place to buy a home with the average price being £167,594.

Commenting on the housing market in the UK, Kim Kinnaird, director at Halifax Mortgages, which is owned by Lloyds Banking Group, said it “continues to display a degree of resilience in the face of tough economic headwinds”.

“In particular, we’re seeing activity among first-time buyers hold up relatively well, with indications some are now searching for smaller homes, to offset higher borrowing costs,” she added.

Last week, the Bank of England raised interest rates for the 14th time in a row. The increase from 5% to 5.25% will lift the cost of borrowing money for many mortgages.

On Monday, the average two-year fixed mortgage rate ticked lower to 6.84%, while the average five-year deal was unchanged at 6.35%, according to financial data firm Moneyfacts.

But there have been suggestions that the current interest rate level could be the peak for consumers, with banks and building societies starting to cut mortgage rates, according to Laura Suter, head of personal finance at AJ Bell.

Andrew Bailey, the Bank of England’s governor, told the BBC there was an “adjustment” to house prices going on. But he cautioned: “I think we should avoid preaching crisis at this point, it’s not that.”

Have you been affected by the issues raised in this story? Get in touch.

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

Last week, the Nationwide building society said that house prices in July recorded their sharpest fall in 2009 but they remained £45,000 higher than February 2020, the last month before the first lockdown.

During the height of the Covid pandemic, house prices soared as people who were forced to work from home at the time decided they wanted more space inside and out. The market was also boosted by a stamp duty holiday.

Halifax’s Ms Kinnaird said while house prices will continue to fall into next year, she expects “a gradual rather than a precipitous decline”.

“And one that is unlikely to fully reverse the house price growth recorded over recent years, with average property prices still some £45,000, or 19%, above pre-Covid levels,” she added.

Marc von Grundherr, director of Benham and Reeves estate agents, said considering the surge in house prices during the pandemic, “it is actually quite remarkable that the market is still standing so strong given the wider economic picture”.

But LSL Property Services, one of the UK’s largest providers of mortgage and valuation services, warned that its full-year profits would be “substantially lower” than previously forecast due to rising interest rates hitting homebuying activity.

The company’s share price tumbled by 13.8% on the warning.

LSL Property Services, which owns mortgage adviser Primis and estate agency Your Move, said that “the larger than expected increase” in the Bank of England base rate in June – when it rose by half percentage point – had “had a material impact on the mortgage market”.

Nationwide said prices had dropped by 3.8% in the year to July. The figure paints a slightly different picture to Halifax’s figures, which suggest prices have fallen by 2.4%.

Each lender bases their data on their own mortgage approvals, meaning their calculations may differ.

This video can not be played

To play this video you need to enable JavaScript in your browser.

What happens if I miss a mortgage payment?

- If you miss two or more months’ repayments you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, such as lower repayments for a short time

- They might also allow you to extend the term of the mortgage or let you pay just the interest for a certain period

- However, any arrangement will be reflected on your credit file, which could affect your ability to borrow money in the future

Read more here

Related Topics

- Personal finance

- Housing market

- UK economy

- Mortgages

-

House prices are falling, so why can’t I afford a home?

-

2 days ago

-

-

UK house prices fall at sharpest rate for 14 years

-

6 days ago

-