The latest in a string of branch closures will see the final bank close in Richmond, which is Prime Minister Rishi Sunak’s constituency.

A shared banking hub will replace the Barclays in the North Yorkshire town, the 100th location earmarked for a hub.

The move comes a day after Lloyds Banking Group said it would shut 45 branches next year, and Metro Bank announced a review of opening hours.

Labour has called for shared banking hubs to be opened quicker.

It is not yet clear if the closure of the Richmond branch, which will shut in December next year, is part of a wider programme by Barclays.

In August, the government said banks would face fines if they failed to provide free access to cash withdrawals for consumers and businesses.

A planned policy will state that free cash withdrawals and deposits must be available within one mile for people living in urban areas. In rural areas, where there are concerns over “cash deserts”, the maximum distance is three miles.

A voluntary arrangement is currently in place which means every High Street should have free access to cash within 1km.

Closures

Nearly 6,000 branches have closed since the start of 2015, according to the consumer group Which?, with scores more already scheduled to close next year.

Campaigners fear some retailers could stop accepting cash if it becomes too tricky to process.

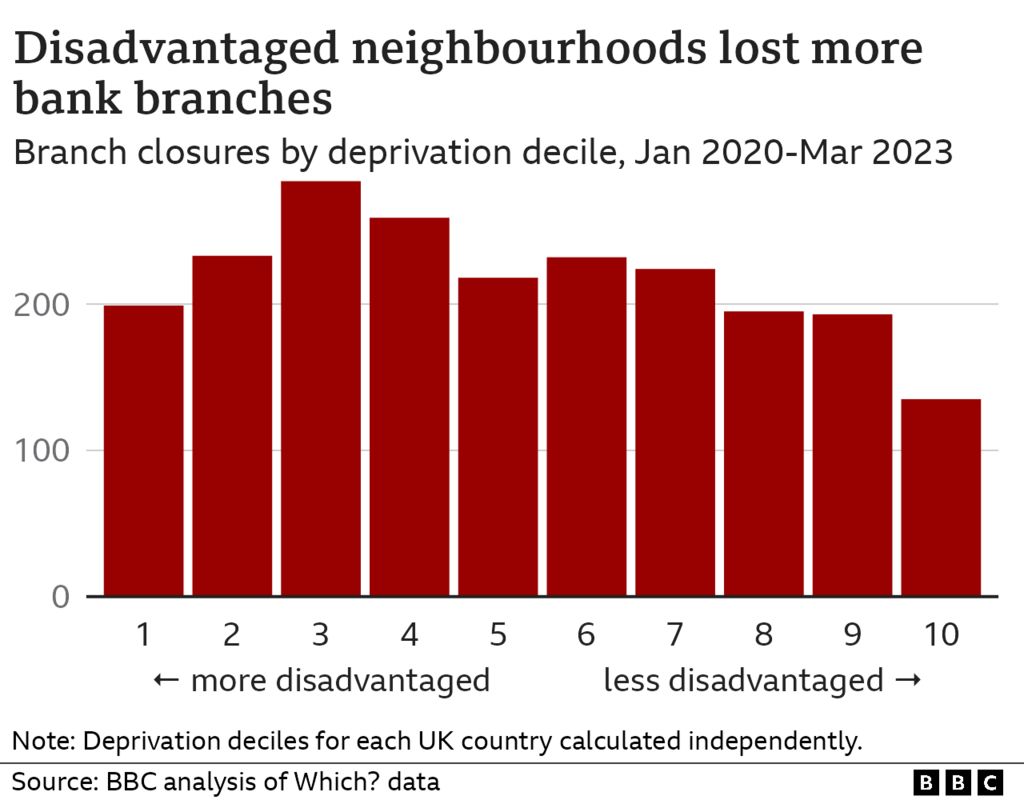

Cash remains a necessity for millions of people, research has found, with the elderly and those with disabilities among those likely to struggle. Branches have been more likely to close in disadvantaged areas.

So-called banking hubs are spaces shared by several different High Street banks and are meant to help communities that have seen all their bank branches close.

While welcomed in communities where they have opened, there has been criticism that relatively few are operating.

- Saving cash: A customer said we’d changed her life

Labour plans to ensure that 350 will open.

Shadow chancellor Rachel Reeves said: “Labour’s plan will bring banking services back to communities who have seen them disappear over recent years, meaning more people across the country will be able to access the services they need closer to home.”

Natalie Ceeney, who wrote a major report into access to cash and oversees the opening of hubs, said: “Over the past month we’ve been opening more than a hub a week.

“Last week we were opening Hubs in Cumbria, Derbyshire and Devon. This week and next we’re in Lincolnshire, London, County Durham, County Down and Denbighshire. We will have 30 banking hubs open by the end of the year and 50 by Easter.”

Ron Delnevo, who chairs the Payment Choice Alliance, “A total of 350 Bank Hubs is nowhere near enough to replace the thousands of bank branches lost in the last five years.”

He said the major High Street banks should be compelled to provide support staff in all 11,500 post offices around the country to ensure community financial services, including access to cash, is maintained.

On Thursday, Lloyds Banking Group said it would close 22 Halifax branches, 19 Lloyds branches and four Bank of Scotland branches next year.

Metro Bank has said it will review whether to stay open seven days a week, and plans to cut 20% of its workforce.

Related Topics

- UK banking

- Cash

- Money

- Personal finance

-

Metro Bank to review seven-day opening and cut jobs

-

23 hours ago

-

-

Fine threat if banks fail to provide access to cash

-

18 August

-

-

Saving cash: A customer said we’d changed her life

-

28 April 2021

-