Cash use has grown for the first time in 10 years as shoppers keep a close eye on their budgets while prices rise, retailers have said.

The British Retail Consortium said 19% of purchases were made with notes and coins last year, echoing a report by banks showing a slight rebound.

The figures come as the UK’s financial watchdog has proposed new rules to help maintain access to cash.

Ministers say banks will be fined if money cannot be withdrawn or deposited.

Under government rules, free withdrawals and deposits will need to be available within one mile for people living in urban areas.

In rural areas, where there are concerns over “cash deserts”, the maximum distance is three miles.

Shoppers’ choices

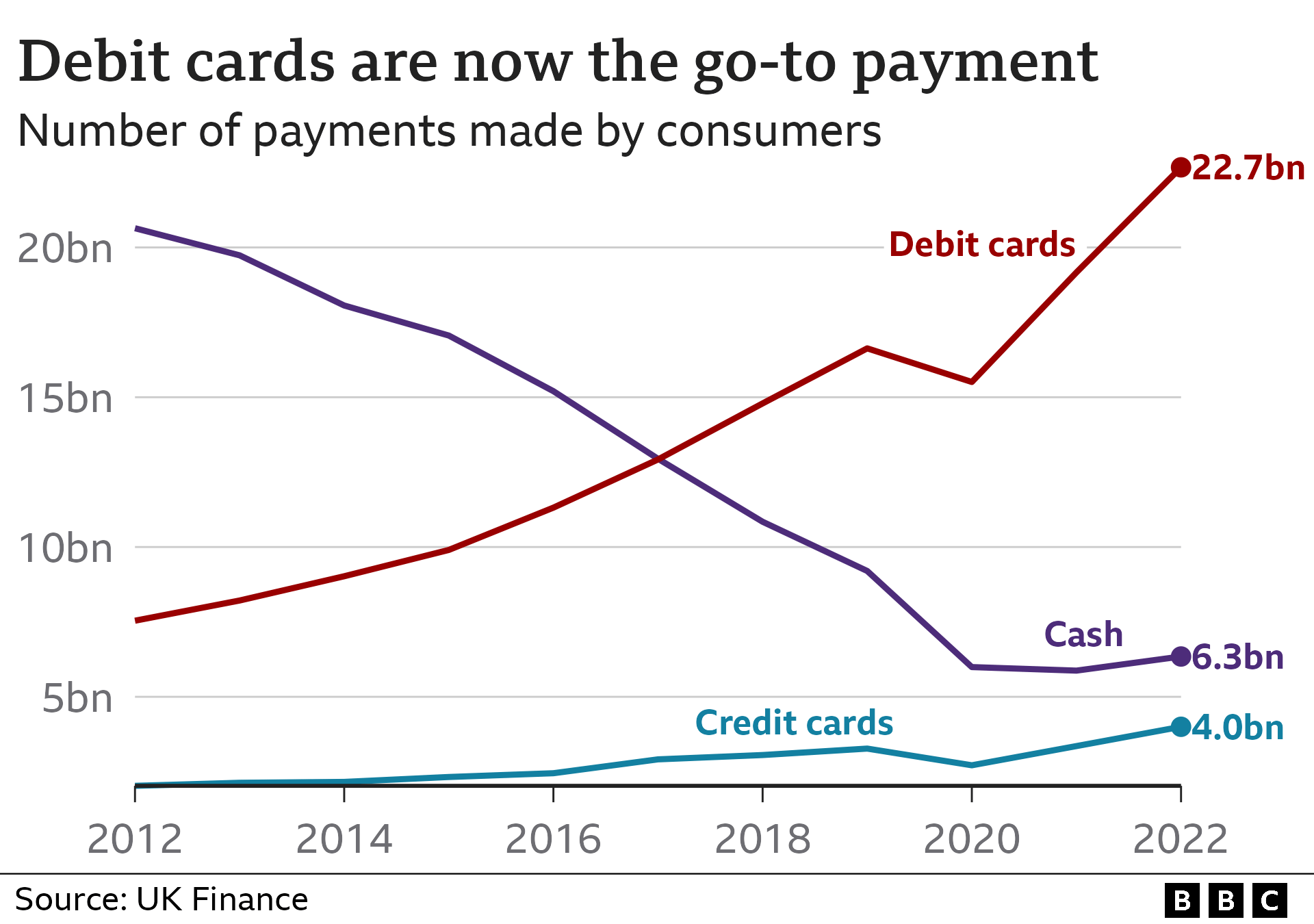

Cash was used in 19% of transactions last year, according to retailers, up from 15% the previous year. Until 2015, notes and coins were used in more than half of transactions and, while card use now dominated, cash still had its benefits.

The consortium said consumers were budgeting carefully to try to cope with cost of living pressures, and there was also a “natural return” for cash after it slumped during the pandemic.

Its payments policy adviser, Hannah Regan, said: “We are now seeing a return to many of the pre-pandemic trends in payments, including smaller but more frequent purchases, and a slight return of cash payments.

“Unfortunately, what has not changed, is the ever-increasing scale of fees paid by retailers in order to accept card payments.”

In September, banking trade body UK Finance also reported that cash use had risen for the first time in a decade, pointing to the financial impact of rising prices.

But it said it expected cash use to decline over the coming years, once the current financial squeeze had eased.

UK Finance said nearly 22 million people only used cash once a month or not at all last year.

However, about five million people still rely on cash and there has been pressure to ensure access is still available as bank branches and ATMs shut.

Among a string of closures announced last week, was the final bank in Richmond, North Yorkshire – part of Prime Minister Rishi Sunak’s constituency – which will be replaced with a shared banking hub.

The Treasury wants to maintain the current level of coverage of free access to cash, through ATMs or face-to-face services, but says that could be diluted as cash use falls.

A voluntary arrangement is currently in place which means every High Street should have free access to cash within 1km.

The UK’s financial watchdog, the Financial Conduct Authority, (FCA) proposed new additional rules on Thursday requiring banks and building societies to assess and plug gaps in local cash provision.

The FCA’s consultation document showed that in the two years to the first quarter of 2023, 1,391 bank and building society branches closed, as did 2,176 free-to-use ATMs.

Under the new rules, designated firms will be required to look at gaps in access to cash across local communities and act if necessary. In their assessments, lenders will need to take into account factors such as transport links and the age of the local population.

The FCA wants to prevent people and businesses from facing unreasonable costs to access their money, which could be through charges, travel costs or time.

Lenders will be required to provide “reasonable” additional cash services to fill gaps where assessments show that there is, or will be, a big local gap. They must also ensure they do not close cash facilities, including bank branches and ATMs, until those extra services are available.

Sheldon Mills, executive director of consumers and competition at the FCA, said: “We know that, while there is an increasing shift to digital payments, over three million consumers still rely on cash – particularly people who may be vulnerable.”

He added that the new rules outlined under the proposals would “help manage the pace of change and ensure that people can continue to access cash if they need it”.

The plans follow new powers granted to the regulator by the Financial Services and Markets Act 2023, although they will not enable the FCA to prevent bank branches from closing.

Have you been using cash more often when shopping? Do you have problems accessing cash? Share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.

Related Topics

- UK banking

- Cash

- Money

- Personal finance

- Cost of living

-

Bank closures hits Rishi Sunak’s constituency

-

6 days ago

-

-

Fine threat if banks fail to provide access to cash

-

18 August

-

-

Why more pain is still to come from high interest rates

-

26 November

-

-

Students cut back on food as cost of living soars

-

6 September

-