When Bella Betterton fell victim to a recruitment scam and had £3,000 stolen, she felt “attacked” and “distraught”.

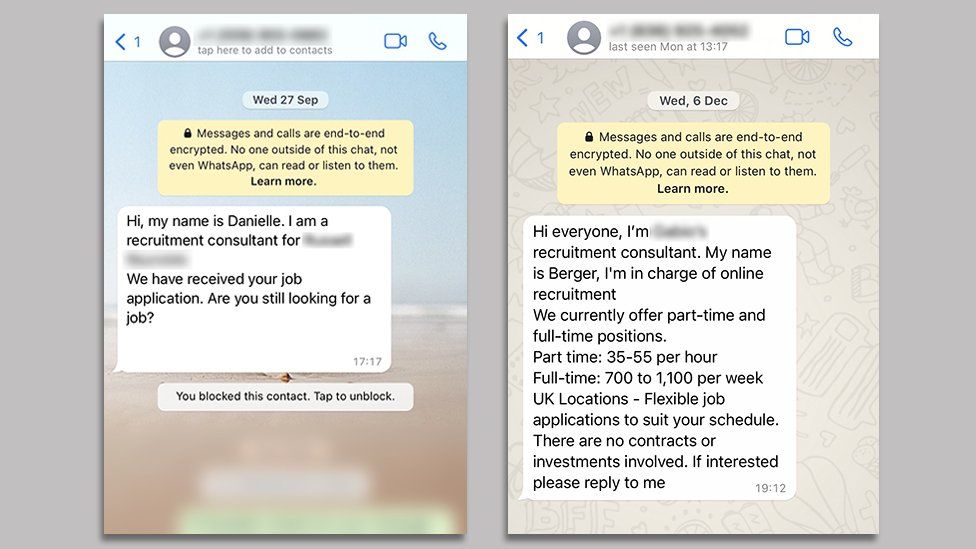

The 18-year-old had been contacted by scammers first via WhatsApp messages and then phone calls and thought she had taken part in a real job interview.

But the fraudsters tricked her card details out of her to steal the money.

New figures show the amount of money reported stolen via recruitment scam text and WhatsApp messages jumped from £20,000 to nearly £1m in the past year.

City of London Police say the number of people reporting these scams to Action Fraud increased more than eightfold.

But this may just be “the tip of the iceberg”, according to City of London Police Temporary Commander Oliver Shaw, as this type of fraud is “hugely underreported”.

Sophisticated scam

Recruitment scams involve criminals luring victims with the promise of extra work or income before conning them out of bank details or taking control of their phones to steal money.

Bella, from Devon, contacted Radio 4’s Money Box after she became a victim in October.

She is hoping to start a five-year biochemistry degree next year so has taken a gap year to try to save up £10,000 to be able to afford to start studying.

The £3,000 that was stolen was all the money she had managed to save up by working full-time over the summer.

“I’d just lost a job I’d had for three years and was trying to find my feet again to be able to keep saving for uni,” she says.

“I’d put my CV out there so thought it [the scam text message]… was a legitimate thing.”

The scammers carried out what Bella thought was a genuine interview with her over the phone for a remote working job involving her using their money to buy and review products.

So sophisticated was the scam the criminals groomed Bella with dozens and dozens of messages and phone calls until, over the course of a few hours one afternoon, they used all the details they’d tricked out of her, along with what she suspects was malware put on her phone, to make four large card payments to a cryptocurrency exchange using her money.

“When I looked at my phone and saw all these payments… [I felt] complete shock, panic. I didn’t know if I could stop them, if there was a way of sorting it out.

“I didn’t know how to cancel or talk to people or to protect my bank account. I’d never dealt with anything like this before.

“I felt quite attacked by it. It was three months’ of work, the whole summer, 50 to 55-hour weeks. So I was pretty distraught and upset by it all.”

How to report a scam message

WhatsApp has lots of advice on how to protect yourself from scams on its website.

You can report a scam text message by forwarding it to 7726 which spells out SPAM on a keypad. If it’s a spam email forward it to report@phishing.gov.uk

Valuable data

Figures from City of London Police show 15 people reported being scammed out of £20,040 to Action Fraud in 2022.

Last year, 126 people reported £977,581 being stolen.

Dr Lis Carter, a criminologist at Kingston University who is an expert in the language and phrases fraudsters use to trick their victims, says recruitment scams are a high-volume, multi-stage crime.

“These text messages will only be relevant to a certain number of people… but it’s a numbers game. Criminals only need a few people to respond and the victims are self selecting.

“Fraudsters will take a victim through several stages, things you’d normally expect a HR department to be asking – name, address, date of birth, bank details.

“All of that stuff is valuable data in itself, so even if that case doesn’t turn into fraud it’s valuable data they can sell on the dark web.”

She says the scammers might ask for small amounts of money upfront, which they claim will be reimbursed in a victim’s first pay cheque for what are genuine things – such as DBS checks, security checks, small bits of equipment – and that once a victim is invested, they can throw more good money after bad.

“The big amounts of money is where the payoff is in these scams,” she says.

“Obtaining bank and card details details… taking control of your computer or phone with the promise of helping victims to remote work – we’ve all done these things for legitimate reasons and scammers use the same scripts.”

Tackling fraud effectively requires “a whole-system response across government, law enforcement and industry”, says Temporary Commander Shaw.

“Every report we receive from the public helps build a stronger picture of the problem, enabling us not only to investigate fraud more effectively, but to take down the bank accounts, websites and phone numbers used by criminals.”

Bella’s bank has refused to refund her as a victim of fraud, although she is now challenging that decision with the Financial Ombudsman Service.

Meanwhile, she is working even more hours as a waitress to try to make up the money that was stolen, and says what’s happened has changed her as a person.

“It makes you feel very immature for this world, very quickly. It’s a big wake-up call.”

You can hear more on this story shortly after broadcast on Money Box.

Follow Money Box and Dan on X (formerly Twitter)

Related Topics

- City of London Police

- Devon

- Internet fraud

- Fraud

-

Banks dragging their feet over fraud refunds – MP

-

10 November 2023

-

-

‘My business had £1.6m stolen in 20 minutes’

-

22 October 2023

-

-

Bank staff defy customers to prevent £55m of fraud

-

26 July 2023

-

-

Woman loses £3,000 in ‘Hi mum’ scam

-

24 April 2023

-