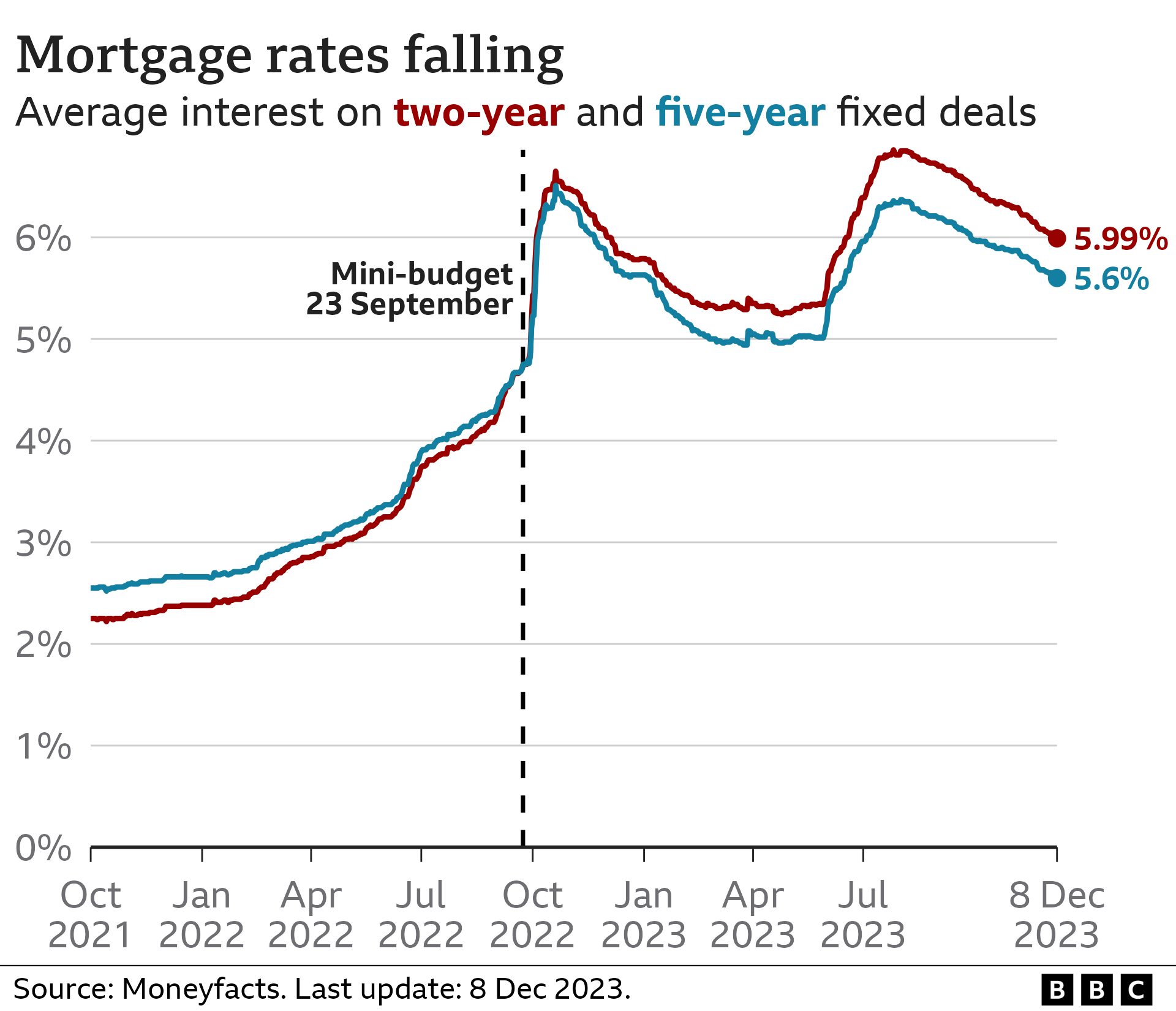

Mortgage rates on a typical two-year fixed deal have fallen below 6% for the first time since mid-June, according to Moneyfacts.

The financial information service said the average rate was now 5.99%.

Competition among providers has intensified as they face a battle to attract a small pot of new homeowners, and to maintain current custom.

They have been given added confidence as many analysts suggest the Bank of England’s base rate has now peaked.

The rate on a typical two-year fixed mortgage rose sharply during Liz Truss’s premiership, then fell slightly before rising again.

It peaked at 6.86% in late July, and has been falling steadily since.

David Hollingworth, from broker L&C Mortgages, said that the best rates for two-year fixed deals were below 5%, or under 4.5% for five-year deals.

However, this was still significantly higher than many homeowners paid for more than a decade, and many of these deals were close to their end date.

The Bank of England’s latest Financial Stability Report estimated five million mortgage holders would see their mortgage payments rise by 2026.

According to the Bank’s estimates, just under 900,000 will see mortgage payments jump by more than £500 a month due to higher interest rates.

About a fifth of those are predicted to see a jump of more than £1,000 per month.

But the number of households predicted to spend more than 70% of their post-tax income on their mortgage by the end of next year has fallen to 500,000 from the 650,000 predicted in July.

- Mortgage arrears up sharply with landlords hit hard

- Rental pressure pushing families to smaller homes

Mr Hollingworth said some lenders may have “overshot” when setting their mortgage rates during the summer as the Bank rate was rising. It has now been held twice at 5.25%.

He said mortgage rates were now at more historical norms, but would still be painful after years at a low level. Many were choosing a two-year, rather that a five-year, deal in the hope rates would fall further, although there were no guarantees of that scenario.

He suggested people searching for a new mortgage prepare early, lock in a product that suits them, then review before their current deal expires.

“The danger is not to do anything,” he said, pointing out that default standard variable rates were often very expensive.

What happens if I miss a mortgage payment?

- If you miss two or more months’ repayments you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, such as lower repayments for a short time

- They might also allow you to extend the term of the mortgage or let you pay just the interest for a certain period

- However, any arrangement will be reflected on your credit file, which could affect your ability to borrow money in the future

Read more here.

A separate report by the Institute for Fiscal Studies (IFS) found that almost half of first-time buyers between 2018 and 2020 received financial help to purchase a property, primarily from parents.

It suggested that they typically received £25,000 towards a deposit of £55,000.

Between 2009 and 2019, the homeownership rate for those aged 25 to 39 fell from 55% to 43%. In this age group, the children of homeowners were more than twice as likely to be homeowners as the children of renters.

The IFS said this could have long-term consequences for inequality of homeownership and wealth.

Related Topics

- Money

- Personal finance

- Housing market

- Cost of living

- Mortgages

-

Mortgage problems ease but many face ‘price shock’

-

2 days ago

-

-

Mortgage arrears up sharply with landlords hit hard

-

9 November

-

-

Benefits falling behind rising cost of living

-

3 days ago

-

-

Rental pressure pushing families to smaller homes

-

29 November

-