This video can not be played

To play this video you need to enable JavaScript in your browser.

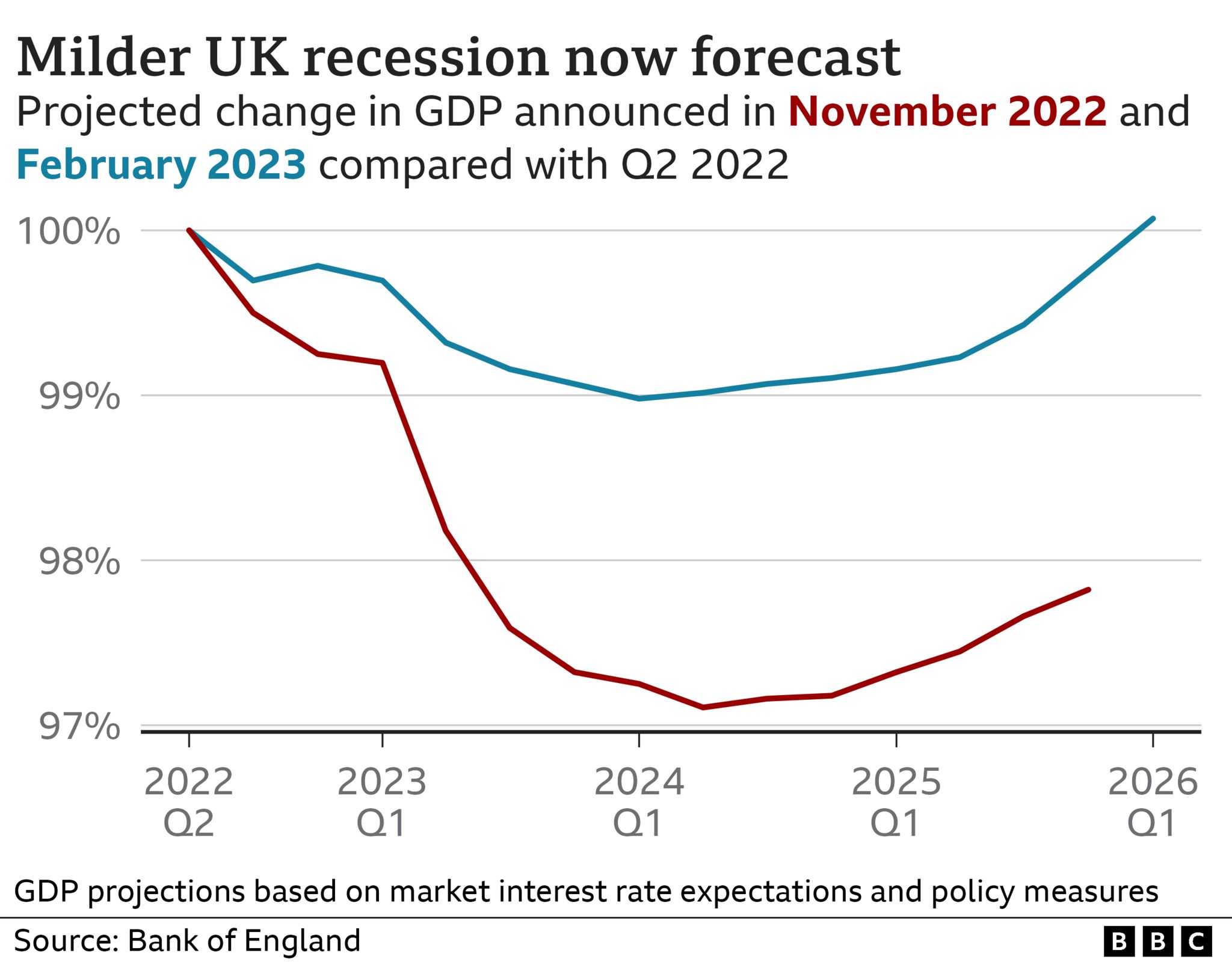

The UK is set to enter recession this year but it will be shorter and less severe than previously thought, according to the Bank of England.

The slump is now expected to last just over a year rather than almost two as energy bills fall and price rises slow.

As a result fewer people are likely to lose their jobs, but the economy remains fragile, said the Bank’s governor Andrew Bailey.

The fresh forecast came as the Bank raised interest rates to 4% from 3.5%.

It is the tenth increase in borrowing costs in a row and will add pressure to many households already struggling with the cost of living.

The impact will be felt by borrowers through higher mortgage and loan costs, although it should also mean better returns for savers.

Homeowners with a typical tracker mortgage will now pay about £49 more a month. Those on standard variable rate mortgages face a £31 increase.

- Rates may have peaked, but economy remains fragile

- What the rise in interest rates means for you

- Why does the Bank of England change interest rates?

The Bank’s predictions come after a separate forecast from the International Monetary Fund (IMF) suggested the UK would be the only major economy to shrink in 2023, performing worse than even Russia.

The bank’s forecast is slightly more pessimistic than the IMF and it said that the UK economy would be weak for some time.

Andrew Bailey, governor of the Bank of England, told the BBC that he “very much hopes” the UK is past the worst point in its current economic travails.

But the country is not expected to bounce back to pre-Covid levels until 2026, which Mr Bailey said was “extraordinary”.

He said: “We may have to conclude that Covid has had bigger long-run effects than we thought it would, particularly in terms of things like the labour supply and people choosing to come out of participating in the labour force.”

The UK has a record 1.1 million job vacancies while the number of people classed “economically inactive” – which is people aged between 16 and 64 not looking for work – has risen.

Mr Bailey said that in most countries, the number of economically inactive workers had fallen since the height of the pandemic, but this was not the case in the UK.

“That is what marks the UK out,” said Mr Bailey.

Softer stance on rates

It has been putting up interest rates to tackle inflation, which at 10.5% remains close to its highest level for 40 years – more than five times what it should be.

Higher interest rates are meant to encourage people to save more and spend less, helping to stop prices rising as quickly.

In November, the Bank said it would act “forcefully” to control rising prices, but on Thursday softened its stance saying it only raise rates further if it saw further signs inflation would remain high.

How is the rising cost of living affecting you? Get in touch.

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

The Bank previously expected the UK to fall into recession at the end of last year, with the downturn lasting until the middle of next year. It now expects the slump to be shorter – starting in the first three months of this year and lasting until the end of March next year.

A recession is defined as when the economy shrinks for two consecutive three-month periods. Typically companies make less money and cut jobs, leaving the government with less tax revenue to spend on public services.

The Bank is now predicting:

- The economy will shrink by 1% versus 3%, largely because “wholesale energy prices have fallen significantly.”

- The unemployment rate will peak at 5.3% rather than 6.4%. It is currently 3.7%.

- Inflation will fall back to 8% in June before dropping further to 3% by the end of the year.

- If workers get big pay rises it could lead to a slower fall in inflation.

‘I’ve docked my wage and reduced opening hours to cut costs’

Business owner Jo Williams is worried about the extra costs of an interest rise for her bed sales company and gift shop in Nuneaton.

The mortgage costs for the bed shop warehouse has gone up by £150 per month and her own home mortgage is also creeping higher.

To make up those losses, Jo has cut opening times from 9.30am to 5pm to 10am – 4pm and for the first time in 8 years, has made one member of staff redundant.

- What happens if I can’t afford to pay my mortgage?

- Why are prices rising so much?

“We tried everything to secure that job but it’s a case of having to keep a very, very close eye on cash flow right now,” she explained.

Financial markets widely expect interest rates to peak at 4.5% this year to help drive down inflation. The Bank is expected to raise borrowing costs more gradually compared to recent steep increases. Some economists believe the Bank will hold interest rates at 4.5% for some time before contemplating a cut.

Chancellor Jeremy Hunt said the government would act in “lockstep” with the Bank to tackle inflation. This meant resisting the urge “to fund additional spending or tax cuts through borrowing, which will only add fuel to the inflation fire”.

But Labour’s shadow chancellor Rachel Reeves said: “The reality is that under the Tories growth is on the floor, families are worse off and we are stuck in the global slow lane.”

-

What the rise in interest rates means for you

-

4 hours ago

-

-

Why are prices rising so much?

-

18 January

-

-

Why does the Bank of England change interest rates?

-

15 December 2022

-