The UK economy will get worse before it gets better, Chancellor Jeremy Hunt has said after figures revealed it shrank further between August and October.

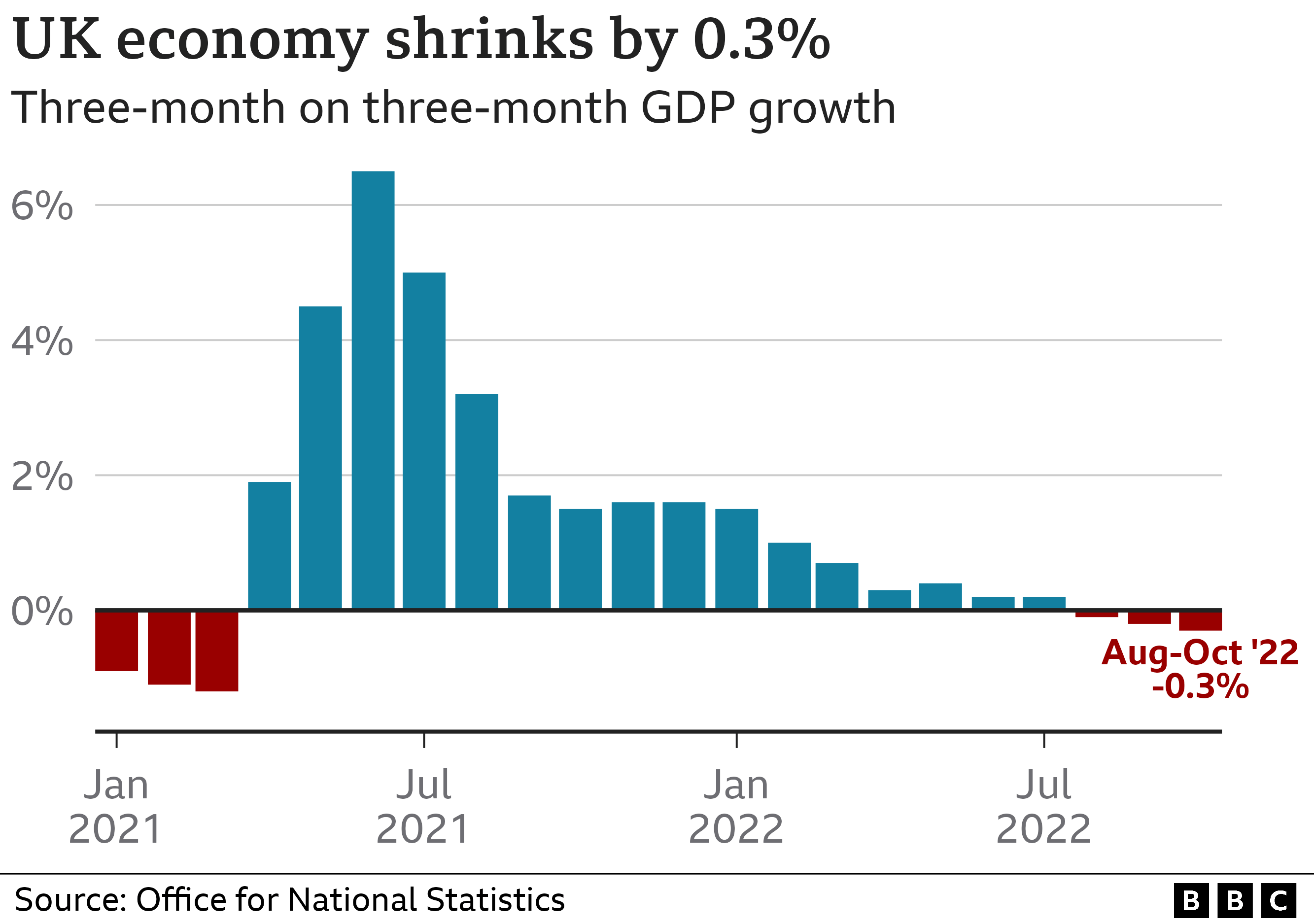

The economy contracted by 0.3% during the three months as soaring prices hit businesses and households and the UK is forecast to be heading into recession.

He said: “These figures confirm that this is a very challenging economic situation here and across the world.

“And it will get worse before it gets better.”

Over the three months, economic activity in the UK slowed across all the main sectors including production, construction and services.

A country is in recession when its economy shrinks for two three-month periods in a row.

In his Autumn Statement last month, Mr Hunt said the UK was already in recession. This is expected to be officially confirmed at the beginning of next year when economic figures for October to December are released.

When a country is in recession, it is a sign that its economy is doing badly. During a downturn, companies typically make less money and the number of people unemployed rises. Graduates and school leavers also find it harder to get their first job.

It also means that the government receives less money in tax to spend on public services such as health and education.

The Bank of England recently said the UK is facing its longest downturn since records began, expecting it to continue next year and into the first half of 2024.

The independent forecaster, the Office for Budget Responsibility, said recently that it expected the recession to last just over a year.

There was a brief respite in October alone when the economy grew by 0.5% compared with the previous month, according to the Office for National Statistics (ONS). However, this rebound came after output was affected in September by the additional bank holiday for Queen Elizabeth’s state funeral, which meant that some businesses closed or had shorter opening hours.

Martin Beck, chief economic adviser to the EY Item Club, said that although the current quarter had started positively with October’s rise, there is “a good chance” the economy will contract.

“The near-term outlook remains gloomy, as consumers continue to struggle under the weight of high inflation and with much of the impact of this year’s interest rate rises still to be realised,” he said.

Last month, the Bank of England raised interest rates from 2.25% to 3% – the biggest jump since 1989. The Bank is expected to announce a further increase on Thursday by half a percentage point to 3.5%.

Donald Nairn, owner of Edinburgh-based retailer Toys Galore, said rising interest rates were one of the reasons his customers were being more cautious about their spending.

“Most people are struggling because they’ve seen all their costs go up – interest [rates], fuel, food – and yet their wages just haven’t kept up so everything’s squeezed.”

He said that while people will still buy toys for a birthday or Christmas present, they may not make the trip into town to buy it or it will be smaller.

“If you’d asked me in 2019 what the next few years would be like I could not have possibly imagined in my wildest dreams it would have been as challenging as it has been,” he added.

Labour’s shadow chancellor Rachel Reeves said Monday’s figures “underline the failure of this Tory government to grow our economy, leaving us lagging behind on the global stage”.

Darren Morgan, director of economic statistics at the ONS, said that some companies had said that strike action had affected their business.

“We speak to about 40,000 businesses every fortnight and one in eight of them tell us they were affected by industrial action in October,” Mr Morgan told the BBC’s Today programme.

“They told us the most common impacts were they were not able to get the necessary goods or services and were unable to operate fully.”

The UK is facing more strikes over pay and working conditions this month and into the New Year. Around 40,000 train and rail workers will walk out on Tuesday as part of a series of strikes.

Royal Mail workers will also continue industrial action this week, with strikes planned for Wednesday and Thursday.

“Businesses are telling us the rail strikes hit hospitality pretty hard in particular,” Mr Morgan said.

He added that industrial action at ports such as Felixstowe had “hit logistics and shipping companies”.

Employment figures from the ONS, which are due out on Tuesday, will give details of the number of days lost due to strikes in October.

At first glance, growth of 0.5% between September and October looks as if it defies all predictions of ongoing slump.

Growth of that scale in a month is actually quite a bounce-back. But then you realise it’s only for artificial reasons rather than a mini-recovery. Car sales and other consumer facing services did bounce back sharply month-on-month, but that’s only because in the previous month the Queen’s funeral meant we all had an extra day off.

Other figures point clearly to recession. The weakness of consumer-facing services – everything from shops to restaurants to sport and leisure – which are still 8.9% below their pre-pandemic levels. And the sharp reduction in electricity and gas use in October, down 4% against the year before.

But it’s the three-month figures that are more reliable and show us the real picture. With activity down 0.3%, the UK economy, in common with much of the rest of the world, is forecast to see the economy continue to shrink through to the end of next year.

What we don’t yet know is how long it might continue beyond that – or how deep the contraction will be.

-

What is GDP and how does it affect me?

-

11 August

-

-

Recession looms as UK economy starts to shrink

-

11 November

-