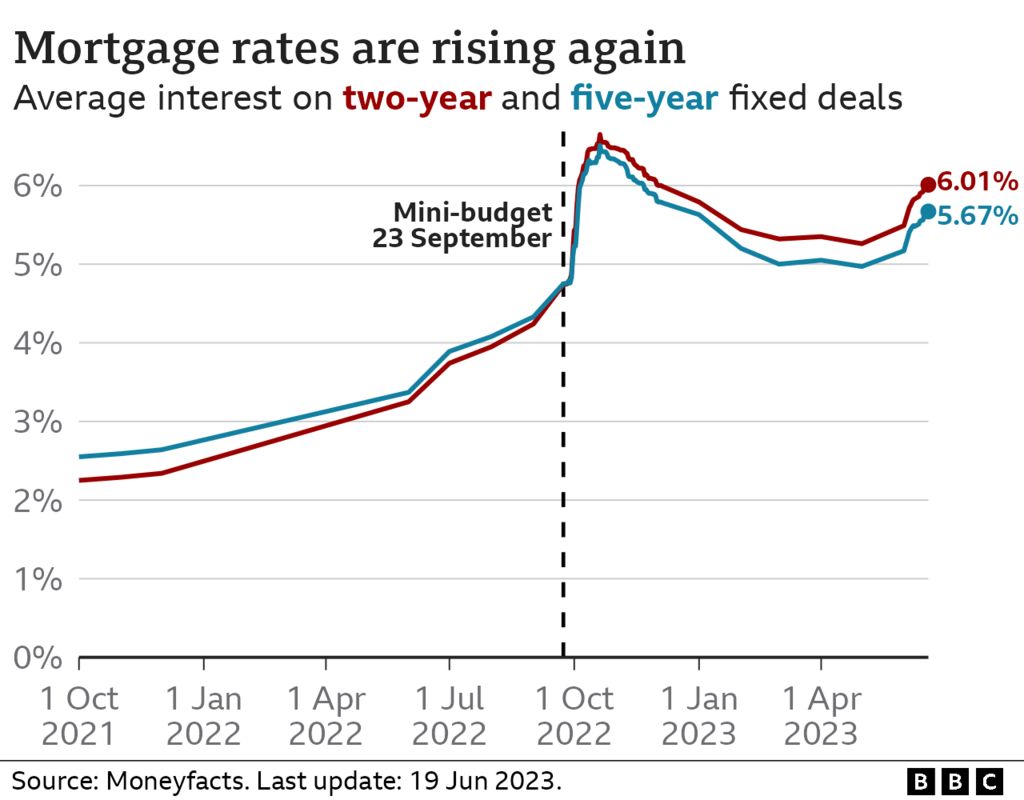

A typical two-year fixed mortgage deal now has an interest rate of more than 6% for the first time since December.

Mortgage lenders have been putting up rates and pulling deals at a rapid rate in recent weeks, driving up costs for homeowners seeking new deals.

Recent high inflation and strong pay growth figures mean interest rates are now expected to rise by more than expected, pushing up borrowing costs.

Rishi Sunak has appeared to rule out any extra support for homeowners.

On Monday, the prime minister told ITV’s Good Morning Britain that his priority was to halve inflation by the end of the year.

“I know the anxiety people will have about the mortgage rates, that is why the first priority I set out at the beginning of the year was to halve inflation because that is the best and most important way that we can keep costs and interest rates down for people.”

On Monday, the average rate for a two-year fixed-rate mortgage stood at 6.01% according to the financial information service Moneyfacts.

The interest rates on mortgages soared to 6.65% after last autumn’s mini-budget before calming slightly. But rates have climbed sharply again recently.

A typical five-year fixed rate is now at 5.67% compared with last year’s peak of 6.51%.

- Will soaring mortgage costs push the UK into recession?

- What happens if I can’t afford to pay my mortgage?

Expectations that interest rates will stay higher for longer have been reflected in the funding cost of mortgages, hitting new borrowers, and those trying to remortgage.

The interest rate for the UK government to borrow money over two years – a key influence on mortgage rates – has been rising sharply, and on Monday it hit 5% for the first time since 2008.

Mortgage lenders have been pulling deals and putting up rates at short-notice, while some have been inundated with demand and so forced to pull or raise rates again.

On Monday, TSB said it was withdrawing its mortgage range sold via brokers, and expected to re-price on Wednesday.

More than 400,000 people will see their existing fixed deals end between July and September, a comparatively high number. Many face the prospect of having to budget for monthly repayments that are hundreds of pounds more expensive than they have become accustomed to.

The Bank of England’s base rate, set by its Monetary Policy Committee and currently at 4.5%, will be reviewed on Thursday and is widely expected to increase for the 13th time in a row.

But at the weekend, a former deputy governor of the Bank, Sir Howard Davies, argued that it should “wait and see” to see the full effect of the rate rises made so far.

“We have a mortgage market where most people are on a fixed rate – when you put up interest rates you only have an impact on the small number of people paying the variable rate and on the people whose fixed rate happens to come up for renewal,” he told the BBC.

“So it’s arguable the interest rate rises we’ve already seen have not yet fed fully through into the impact onto consumer spending.”

On Sunday, cabinet minister Michael Gove told the BBC that help for people struggling with their mortgages was being kept “under review”, although any financial assistance would be a decision for the Treasury.

He also warned that using public money to “deal with particular crises” inevitably added to public debt and risked driving up interest rates further.

The BBC understands that the Treasury has no current plans to give mortgage relief.

On Saturday, a report by the Resolution Foundation found the average cost of remortgaging next year would increase by £2,900.

The think tank also said it did not expect the average two-year mortgage deal to fall below 4.5% until the end of 2027, leaving the UK in the depths of a “mortgage crunch”.

The latest figures from property website Rightmove found that the average asking price for a property coming onto the market has dipped for the first time this year.

The average price fell by £82 in June to £372,812, Rightmove said, noting that mortgage rate rises and high inflation were affecting households’ finances.

Inflation – the rate at which prices rise – is remaining stubbornly high in the UK. The annual inflation rate was 8.7% in April, still well above the Bank’s 2% target.

By raising interest rates, the Bank expects people to have less money to spend and buy fewer things, which should help stop prices rising as quickly.

However, it also makes it harder for firms to borrow money and expand.

The latest official inflation data will be published on Wednesday.

What happens if I miss a mortgage payment?

- A shortfall equivalent to two or more months’ repayments means you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

- Any arrangement you come to will be reflected on your credit file – affecting your ability to borrow money in the future

Read more here

How have you been affected by rising mortgage costs? Share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.

Related Topics

- Money

- Personal finance

- Housing market

- Cost of living

- Mortgages

-

What happens if I can’t afford to pay my mortgage?

-

3 days ago

-

-

Five reasons why mortgages are getting us down

-

11 June

-

-

Mortgage calculator: Will my payments rise?

-

10 May

-

-

How worried should we be about rising mortgage rates?

-

6 days ago

-