Interest rates will stay higher for longer, the Bank of England has said for the first time, in an effort to battle soaring price rises.

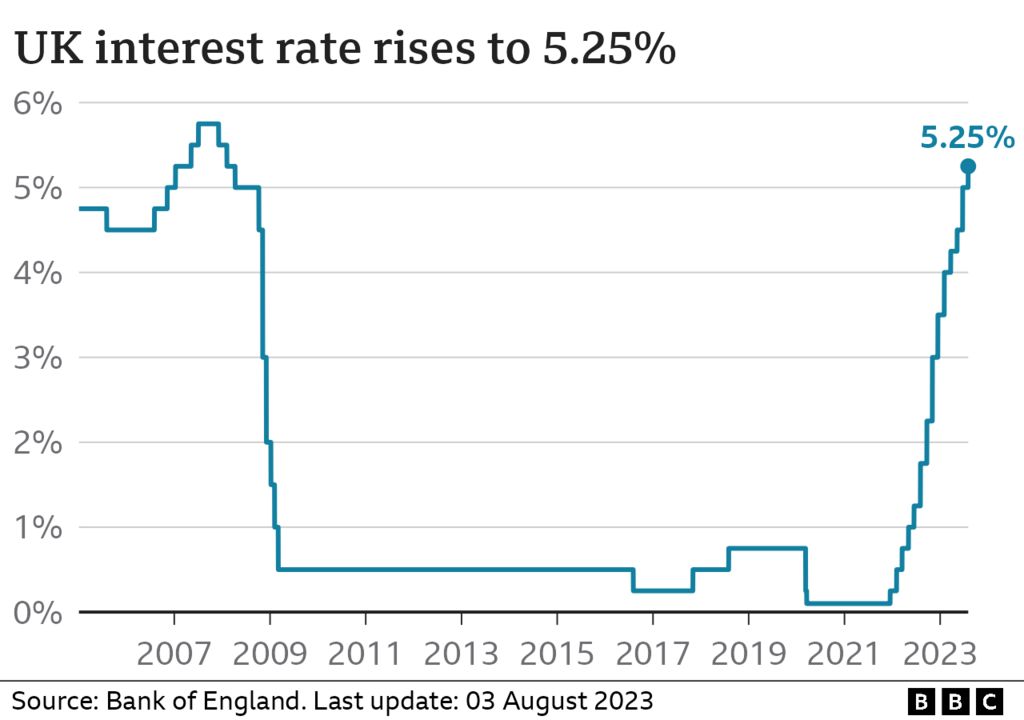

The Bank revealed the tactic to try and curb the rising cost of living as it raised rates again to 5.25% from 5%.

Borrowing costs are now at their highest for 15 years, and will mean higher mortgages and loans payments but should also mean higher savings rates.

The Bank was more downbeat on growth, but said the UK would avoid recession.

On Thursday, the Bank signalled for the first time that it would keep interest rates higher and that they would remain higher until it got UK inflation – the rate at which prices rise – under control.

It said it would make sure rates are “sufficiently restrictive for sufficiently long” but did not spell out how long this would be.

“We know that inflation hits the least well-off hardest and we need to make absolutely sure that it fall all the way back to the 2% target,” said Bank of England governor Andrew Bailey.

The Bank’s inflation forecasts have been incorrect in the past, with six of the last eight too optimistic.

Mr Bailey says it is now “more assured” that inflation will fall than in previous forecasts.

He also says the economy has been “much more resilient” than some had feared and that unemployment remains historically very low.

- Follow live: Reaction to latest interest rate rise

- How an interest rate rise affects you

Before December 2021 when the Bank starting to raise interest rates, they had been under 1% for more than 13 years.

A lot of what happens to inflation in the coming years will depend on the jobs market and on pay, Mr Bailey said adding that private sector pay has risen more than expected in recent months.

The Bank has been putting up interest rates to try to slow price rises, with the aim of making it more expensive to borrow money and reducing people’s spending.

Peterborough hair salon owner Jo Bevilacqua says she understands the economics behind rate rises, but it is a “hard pill to swallow” given that her business is reliant on consumer spending “We are still in pandemic recovery mode. We don’t want people to be spending less. Our livelihoods are in their hands,” she says.

“If they are not spending money then we can’t keep our doors open, pay our staff or pay our suppliers.” Jo’s own finances are not immune from the rates pain either. She moved onto an interest-only mortgage when her business was struggling.

“I need to be in a position where everything calms down to be able to re-mortgage. It comes to me as a three-pronged attack. There are my own mortgage payments going up, but there are also my staff and customers.”

How are interest rate rises affecting you? You can get in touch the following ways:

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload your pictures or video

- Please read our terms & conditions and privacy policy

The Bank said the impact of its rate rises would begin to hit people and the economy harder next year, with growth continuing to be sluggish and smaller than it was before the pandemic for some time.

A growing economy means there are more jobs, companies are more profitable and can pay employees and shareholders more. The higher wages and larger profits also generate more money for the government in taxes.

Rising food prices have been one of the biggest drivers of inflation, but the Bank said there was evidence that the increases were slowing, “albeit only gradually”.

The Bank also said there was no evidence that companies were benefiting from so-called “greedflation”, by putting prices up more than necessary to bolster profits.

It said “corporate profits have been little changed” over the past two years “suggesting that firms increasing prices to raise their margins is not currently a significant contributor to inflation”.

The minutes from this month’s meeting revealed that there was a three-way split between members of the Bank’s Monetary Policy Committee over the direction of interest rates.

Of its nine members, six, including the governor, voted for rates to rise to 5.25%. In contrast, two wanted a more aggressive increase to 5.5% while the remaining member voted to hold rates at 5%.

What to do if I can’t pay my debts

- Talk to someone. You are not alone and there is help available. A trained debt adviser can talk you through the options. Here are some organisations to get in touch with.

- Take control. Citizens Advice suggest you work out how much you owe, who to, which debts are the most urgent and how much you need to pay each month.

- Ask for a payment plan. Energy suppliers, for example, must give you a chance to clear your debt before taking any action to recover the money

- Check you’re getting the right money. Use the independent MoneyHelper website or benefits calculators run by Policy in Practice and charities Entitledto and Turn2us

- Ask for breathing space. If you’re receiving debt advice in England and Wales you can apply for a break to shield you from further interest and charges for up to 60 days.

Tackling It Together: More tips to help you manage debt

Additional reporting by Peter Ruddick

Sign up for our morning newsletter and get BBC News in your inbox.

Related Topics

- Personal finance

- UK economy

- Bank of England

-

Bank of England raises interest rate to 5.25%

-

4 hours ago

-

-

How an interest rate rise affects you

-

1 hour ago

-

-

Five ways to save money on your mortgage

-

23 June

-