Taxpayers are on course to pay £40bn a year by 2028 as a result of the freeze on personal tax thresholds and inflation, new analysis suggests.

The Resolution Foundation said the policy would lead to the country’s biggest tax rise in at least 50 years.

The Treasury said taxes in the UK remained lower than other major European economies.

The government’s policy is to keep income tax and National Insurance thresholds frozen until 2028.

It means millions of people will be pulled into a higher tax band or see a greater proportion of their salaries taxed, particularly those who have secured wage increases.

Inflation has also had an impact. Due to the rate consumer prices rise at being at a high level, many workers secured pay rises to counteract the cost of living.

Some of those pay increases will lead to more people being dragged into higher tax bands, and required to pay tax on a larger proportion of their earnings, a process is known as “fiscal drag” to economists.

The government’s policy was previously predicted to raise some £30bn by the 2027-28 tax year, according to the Resolution Foundation, an independent think-tank focused on improving living standards for those on low to middle incomes.

After studying the Bank of England’s inflation forecasts, it suggests that the government is now set to take in £40bn a year.

- What is income tax and how much will I pay?

It said this was due to inflation in the UK remaining high and forecasts estimating it will remain higher than previously thought, meaning the income tax coffers for the government had “vastly” increased.

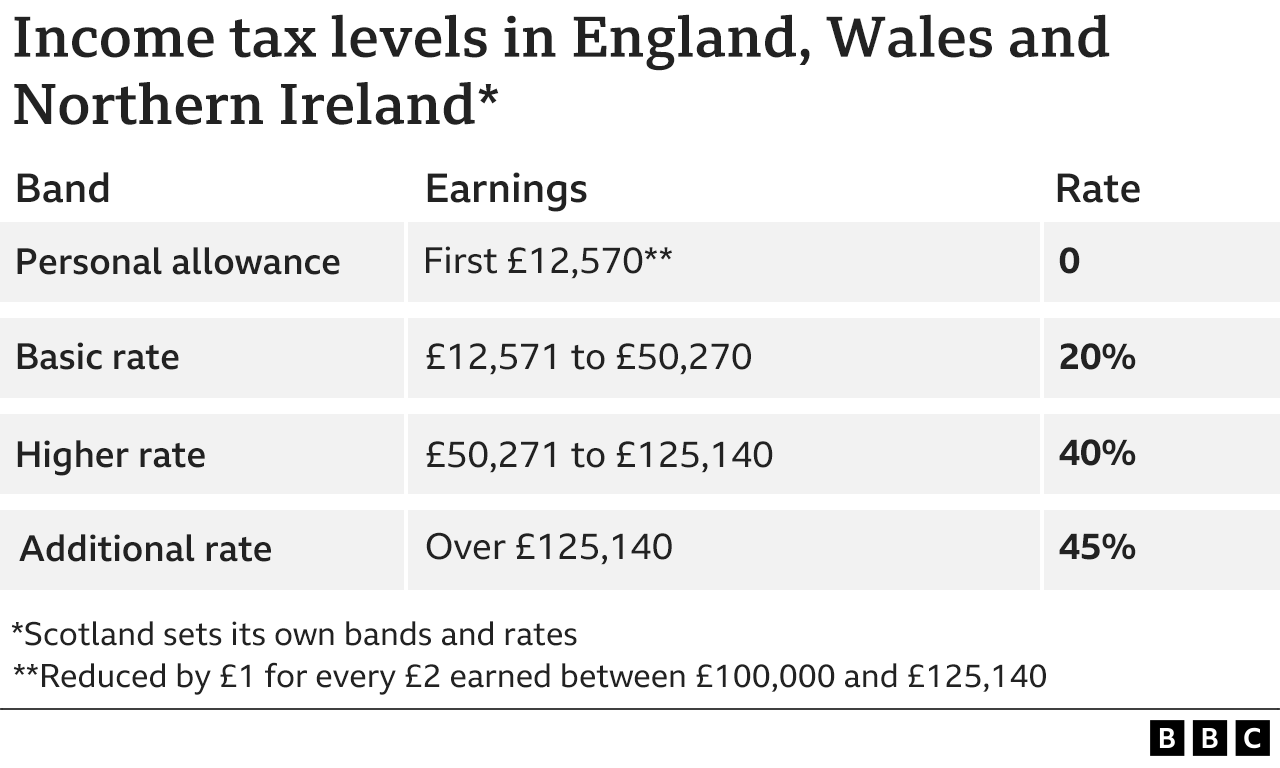

Income tax is the government’s single biggest source of revenue. The basic rate is 20%, meaning one-fifth of the money people earn between £12,571 and £50,270 goes to the Treasury.

In his Autumn Statement last year, Chancellor Jeremy Hunt extended the freeze on income tax and higher rate thresholds for two years further years until April 2028.

He also froze the main National Insurance and inheritance tax thresholds.

The Resolution Foundation said had the government uprated the Personal Tax Allowance with inflation to 2028, people would have started paying income tax at around £16,200, rather the current threshold of £12,570.

It said this meant most basic rate taxpayers would pay £720 more a year.

Adam Corlett, principal economist at the think tank, said “abandoning the usual uprating of tax thresholds” was a “tried and tested way for governments of all stripes to raise revenue in a stealthy way”.

“But it is the far bigger than anticipated scale of the government’s £40bn stealth tax rise that stands out,” he said.

A spokesperson for HM Treasury said taxes were lower in the UK than “any major European economy, despite the difficult decisions we’ve had to make to restore public finances after the dual shocks of the pandemic and Putin’s illegal invasion of Ukraine”.

They said “driving down inflation is the most effective tax cut we can deliver right now”.

“The chancellor has said he wants to lower the tax burden further – but has been clear that sound money must come first,” they added.

Chancellor Jeremy Hunt has said it will be “virtually impossible” to deliver tax cuts until the UK economy improves, despite calls for measures to reduce taxes in the Autumn Statement in November.

Related Topics

- Autumn Statement

- Tax

- Personal finance

- UK taxes

- UK economy

- Income tax