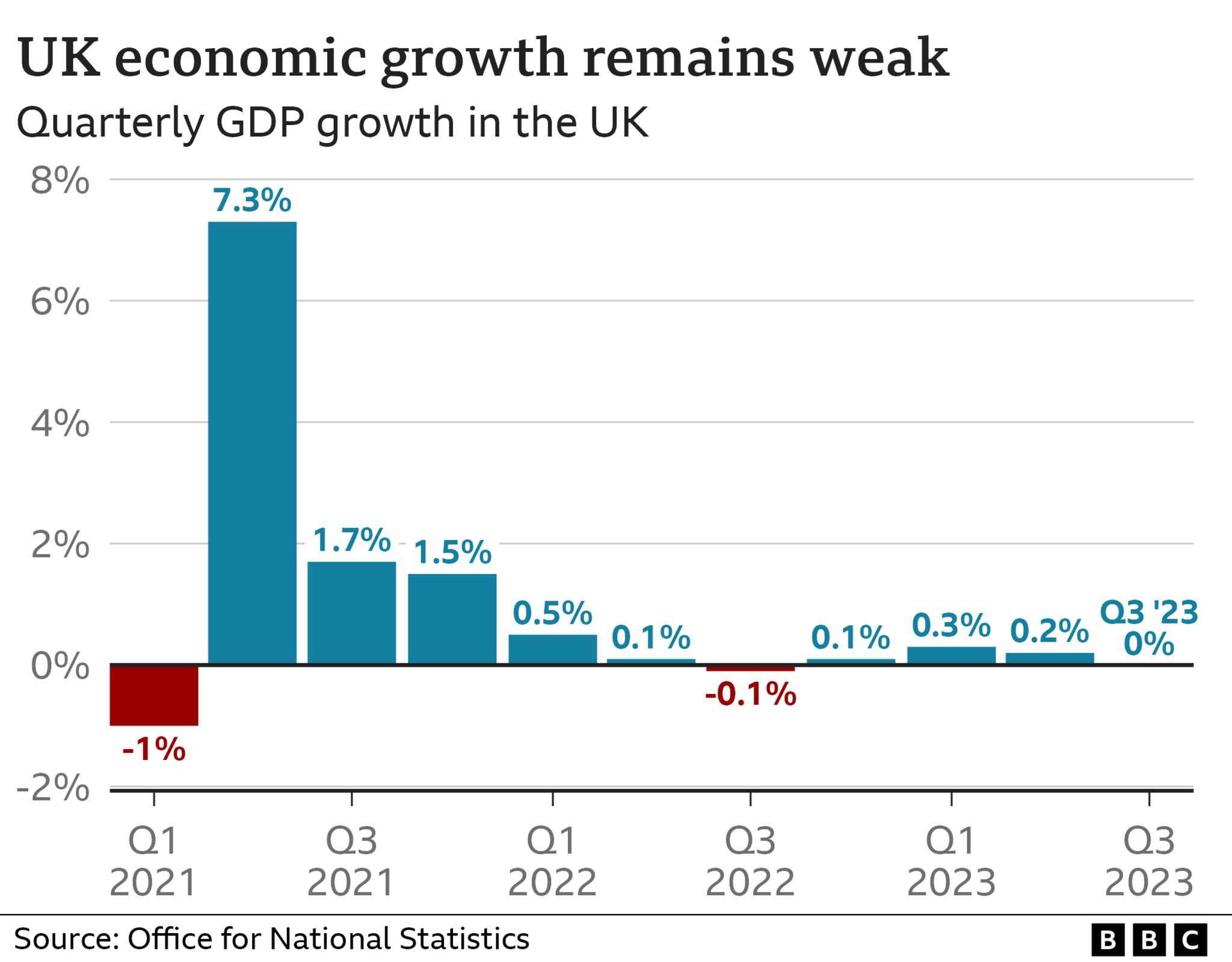

The UK economy failed to grow between July and September, figures show, after a succession of interest rate rises.

The chancellor said higher rates were hitting growth, but added that the economy had performed better than expected this year.

Forecasters suggest the economy is set to be stagnant for several months yet.

Last week, the Bank of England said the UK was likely to see zero growth until 2025, although it is expected to avoid a recession.

Up until September, the Bank of England had raised interest rates 14 times in a row to try to tame soaring price rises.

However, while raising rates can reduce inflation – the pace at which prices rise – it also affects economic growth by making it more expensive for consumers and businesses to borrow money.

Interest rates are at a 15-year high of 5.25%, and are expected to remain high for some time. Bank governor Andrew Bailey said last week it was “much too early” to be considering rate cuts.

Paul Dales, the chief UK economist at Capital Economics, said the latest data suggested “the drag from higher interest rates is growing”, but he does not expect the Bank to start cutting rates until late next year.

- What is GDP and how does it affect me?

- Bank warns it’s too early to cut interest rates

The Office for National Statistics (ONS) said the latest growth figures showed a subdued picture across all sectors of the economy.

The services sector saw a small decline over the three-month period, while manufacturing and the construction sector recorded marginal growth.

The Chancellor, Jeremy Hunt, told the BBC: “Naturally interest rates do have an impact and the judgement of the Treasury is that the main reason growth has slowed is because of that.

“What is perhaps a surprise to many people is that the economy has been much stronger than people thought,” he said.

“Most people thought it was going to contract this year. It’s actually grown, and that gives us an excellent foundation for the future.”

Asked if he would be looking to reduce taxes in the Autumn Statement on 22 November, Mr Hunt said he wanted to bring the tax burden down, but that business tax cuts would take priority over personal taxes. “I’ve always been clear that low taxes are part of a dynamic, successful, entrepreneurial economy, but what I’ve said is my priority is growth, so cutting business taxes is the most important thing at this stage,” he said.

Labour’s shadow chancellor Rachel Reeves said the latest figures were “further evidence that the economy is not working”, while Liberal Democrat Treasury spokesperson Sarah Olney said the Conservatives had “delivered a hammer blow to our economy leading us down a no-growth path”.

Although the rate rises from the Bank are flattening growth, the government may feel a small amount of relief that the risk of a formal technical recession – defined as two consecutive three-month periods of the economy shrinking – has been lowered.

But Prime Minister Rishi Sunak’s vow to “grow the economy” is very much in the balance. Even between July and September, there was a tiny contraction in the economy, though it rounded down to 0.0%.

The growth forecast for the final three months of the year is between 0% and 0.1%, in line with other major European countries, which are also weighed down by rising rates.

The Bank of England may feel that it has started to engineer a softish landing from last year’s excessive inflation.

The government too will point to next week’s likely significant fall in the headline rate of inflation, when the figure is forecast to slow from 6.7% to around 4.8% for October.

It may declare victory on that target on Wednesday, even as its growth target is now under question.

This may change the backdrop to the Autumn Statement later this month and, if it continues, for the general election too as it challenges the clear desire of Downing Street to paint a “turnaround” picture.

As the inflation problem eases, the growth problem could become more prominent.

Dominic Boon, finance director of gift supplier Fizz Creations in Lancing, West Sussex, says it has been a particularly tough year.

The company is coming into the key Christmas period where it makes the most of its money, and Mr Boon has noticed consumer confidence dropping.

“People are struggling with interest rates on their mortgages, on their cars, the cost of living, heating, gas, electricity. Everything is costing more – they have less money in their pockets.”

Down the road is Lucy Lago, who runs her cafe inside Lancing Business Park. “I see people have definitely stopped eating breakfast,” she says, “and their spend per head is obviously going slightly lower. People are being very careful what they buy.”

Gross Domestic Product (GDP) figures show the health of the UK economy. It is a measure – or an attempt to measure – all the activity of companies, governments and individuals in a country.

If the figure is increasing, it means the economy is growing and people are doing more work and usually getting a little bit richer, on average. But if GDP is falling then the economy is shrinking, which can be bad news for businesses.

The zero growth in GDP in the July-to-September period follows 0.2% expansion in the previous three months.

The ONS data also showed the economy grew by 0.2% in September alone compared with the previous month, which was stronger than expected.

Darren Morgan of the ONS told the BBC’s Today programme that while the latest data showed a “very flat picture” overall, there were signs of improvement.

“For example, more than half of businesses were not considering raising their prices in November 2023 – that’s the highest proportion of businesses to tell us this since we first introduced that question in April 2022,” he said.

Six expert tips for finding work

1. Search beyond a 40-mile radius – Remote, hybrid and flexible working open up opportunities further away.

2. Use key words in your searches – Online algorithms will pick up on daily searches and send you more of the same.

3.Don’t wait for a job to be advertised – Contact a manager at a business that you like the look of as you never know what opportunities might be coming up.

4. Sell your skills – Use social media sites like Linkedin which showcase your skills and experience. Other platforms like Twitter and Instagram can prove useful when touting yourself out to potential employers as well.

5. Get learning – While you’re on the hunt for a job see if there are way to fill gaps in your CV with free courses, volunteering or shadowing.

6. Celebrate the small wins – set personal targets, like a tracker of the number of jobs to apply for in a week or a certain number of cold emails and acknowledge the little wins along the way to keep your spirits up.

You can read tips from careers experts in full here.

Related Topics

- GDP

- Economic growth

- UK economy

- Office for National Statistics

-

What is GDP and how does it affect me?

-

1 day ago

-

-

Bank warns it’s too early to cut interest rates

-

2 November

-

-

What is a recession and how could it affect me?

-

1 day ago

-