It is “too early” to speculate about when UK interest rates will be cut, according to the governor of the Bank of England.

Andrew Bailey spoke after the Bank voted to hold interest rates for a third time at 5.25% – a 15-year high.

On Wednesday, the US Federal Reserve signalled that rates were at or close to a peak and could fall next year.

But in contrast, Mr Bailey said it was not possible to “definitively” say the same for the UK.

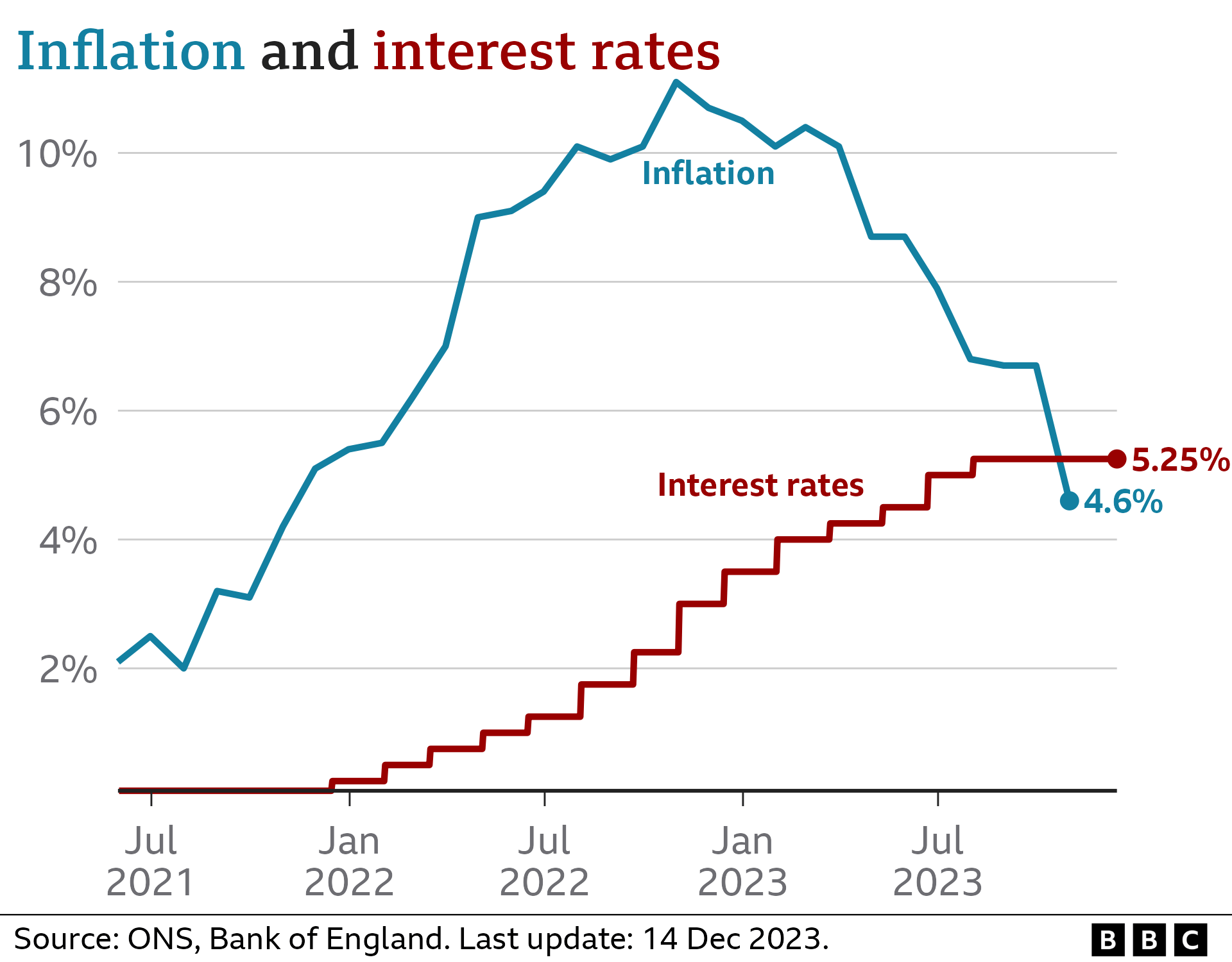

The Bank has lifted interest rates 14 times since December 2021 to cool soaring inflation, which measures the pace at which prices are rising.

In the UK, this has been fuelled by higher energy and food costs following Russia’s invasion of Ukraine.

While price rises have eased to 4.6%, that is still more than double the Bank of England’s 2% inflation target.

“We have seen an unwinding of many of the shocks, the big shocks, that we had last year, particularly related to the war in Ukraine and so on,” Mr Bailey said.

“But there is this persistent element to [inflation] which we have got to take out.”

While he was encouraged by the progress made in slowing down inflation, the governor said: “My view at the moment is it’s really too early to start speculating about cutting interest rates.

“I don’t think that we can say definitively that interest rates have peaked,” he said, but added: “I hope that we are at the top of the cycle.”

- How interest rates affect you and your money

- UK economy falls unexpectedly as higher rates bite

- US rates held as bank signals cuts next year

In the minutes from the Bank’s rate-setting committee meeting, it said interest rates would need to remain higher “for sufficiently long” to return inflation to 2%.

One factor discussed by the Monetary Policy Committee (MPC) was that UK inflation remains worse than in the US and the eurozone.

While the main inflation rate has fallen everywhere, “core inflation [which strips out the most volatile goods] has fallen back by less in the UK” and “measures of wage inflation were also considerably higher in the UK than elsewhere”.

Six out of the nine members of the MPC voted to hold rates at 5.25%, and there was no change to the language in the minutes that rates would remain at these levels for an “extended period”.

It also signalled that interest rates could even rise “if there were evidence of more persistent inflationary pressures”. Indeed, the other three committee members voted for a rise to 5.5% this month.

Despite the Bank keeping rates on hold, some mortgage lenders are making moves with their own rates as they are confident the next move will be down.

Virgin Money and HSBC are reducing rates on their new fixed-rate deals on Thursday. TSB will follow suit on Friday.

Financial markets expect the Bank to start cutting interest rates by next May and some economists believe it has been too pessimistic about inflation.

Recent data has shown that UK pay growth has slowed while the price of Brent crude oil has fallen by 17% between November and December to around $75 per barrel.

The EY Item Club, an economic forecasting group, said it reckoned the Bank would start to rein back its resistance to cutting rates in early 2024.

“Signs of such a shift may start to become apparent when the committee meets next in February,” said chief economic adviser Martin Beck. “The EY Item Club continues to think that the [Bank] will go for the first rate cut in May.”

US signals rate cuts

Jerome Powell, chairman of the US Federal Reserve, showed a degree of cautionin his comments on the outlook for US interest rates after the central bank voted this week to keep them on hold.

“It is far too early to declare victory. There is a lot of uncertainty and we’ve seen the economy move in surprising directions so we’re going to need to see further progress,” he said.

But in the US, inflation has slowed more rapidly and separate forecasts by members of the Fed’s rate-setting panel showed they expected the key borrowing rate to fall from the current range of 5.25%-5.5% to 4.5%-4.75% next year.

Mr Powell also said that the key interest rate was now “likely at or near its peak for this tightening cycle”.

Like the UK and the US, the European Central Bank (ECB) also voted this week to keep interest rates for the 19-nation eurozone on hold, at 4%.

ECB president, Christine Lagarde, said that a cut had not been discussed “at all” by the bank and there remained a wide gulf between raising rates and cutting them.

“It’s like solid, liquid gas,” she said. “You don’t go from solid to gas without going through the liquid phase.”

Looking ahead, the Bank of England said that it expected economic growth to be broadly flat for the final three months of this year and over the coming quarters.

On Wednesday, new data showed that the economy – which is measured by gross domestic product (GDP) – shrank by 0.3% in October.

Related Topics

- Inflation

- UK economy

- Bank of England

-

UK economy falls unexpectedly as higher rates bite

-

1 day ago

-

-

US rates held as bank signals cuts next year

-

19 hours ago

-