An increase in the cost of domestic energy in England, Wales and Scotland has taken effect, adding pressure to household budgets in the new year.

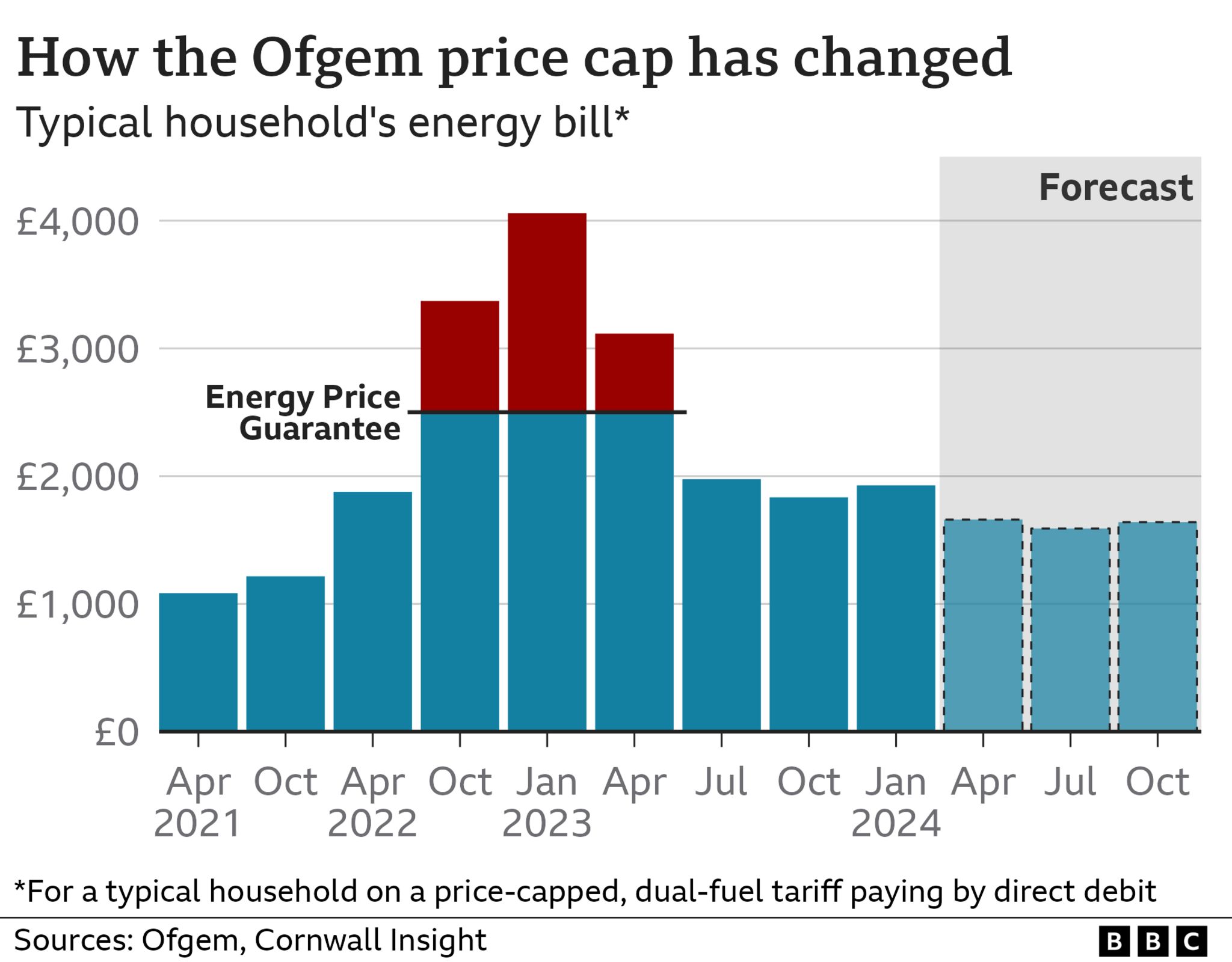

A higher price cap, set by regulator Ofgem, from now to April means gas and electricity costs will be 5% higher than the last three months.

A household using a typical amount of gas and electricity will see their annual bill go up by £94.

But forecasts suggest energy prices could come down sharply in the spring.

Campaigners said the relatively high cost of energy and other essential bills is putting severe pressure on budgets. January tends to be the busiest month for debt charities after Christmas spending, and this year is likely to be the same.

The government said it is supporting households through financial assistance such as cost-of-living payments.

Pay for what you use

Energy regulator Ofgem said the annual bill for a household using a typical amount of gas and electricity, paying by direct debit, has now risen from £1,834 to £1,928.

However, if you use more, you will pay more because the price of each unit of energy is capped, not the total bill.

Specifically, in England, Wales and Scotland:

- The price of gas is now 7p per kilowatt hour (kWh), and electricity is 29p per kWh

- Households on prepayment meters have seen their typical annual bill rise to £1,960

- Those who pay their bills every three months by cash or cheque now have a typical annual bill of £2,058

- Standing charges – a fixed daily charge covering the costs of connecting to a supply – have remained unchanged at 53p a day for electricity and 30p a day for gas, although they vary by region

Prices and the sector are regulated differently in Northern Ireland. Households tend to pay less than the UK average but businesses pay more.

Your device may not support this calculator

Charities said arrears and borrowing to pay essential bills is a serious problem at this time of year.

Ofgem said the amount of energy debt and arrears faced by gas and electricity customers swelled to £2.9bn between July and September.

The regulator is proposing adding £16 to a typical household bill between April and March 2025 to give suppliers the funds to offer prepayment plans and write off debts.

Fuel poverty charity National Energy Action is calling on ministers to introduce a help to repay scheme, as well as a discounted social tariff for those on benefits, and a home energy efficiency programme.

- Energy prices: How much will you pay from January?

- Ofgem warning after Grayson Perry energy bill saga

The latest energy price rise will affect about 29 million households. Of those, about four million have a prepayment meter, so tend to pay for energy as they use it.

That means some more vulnerable households on prepayment meters face particular pressure as price have risen at the coldest and darkest time of year.

Winnie Baffoe is the engagement director at South London Mission, part of Bermondsey Central Hall Methodist Church, which offers charitable and council-funded support such as a warm hub and food parcels.

She said that many families were worried about the cost of food, had limited means to cook as energy costs were high, and were also worried about heating bills.

“It is devastating because it strips away their ability to be a family in the home,” she said. “We have a lovely large hall here and we find the community is using it as a safe place to be, a place to meet other people, but also a place just to keep warm.”

Last winter, overall energy prices were high and rises would have been bigger had it not been for the government’s Energy Price Guarantee limiting the typical bill to £2,500.

But millions of households will pay more for energy this winter than the last, even though prices were higher a year ago.

That is because households received a £400 discount over six months last winter, but the government-funded support has not been repeated this time.

The government said it recognised the challenges that many people were facing and was providing support including the £150 Warm Home Discount and up to £900 in cost-of-living payments for those on means-tested benefits. Further support remained under review.

“We have invested over £2bn into the Household Support Fund over the last two years – with almost £800m already paid to families with children – and the current fund is available through to March 2024,” added a spokesman for the Department for Energy Security.

There is also better news on the horizon for billpayers, as forecasts suggest a sharp fall in energy prices in April.

Consultancy firm Cornwall Insight says a big drop in wholesale prices faced by suppliers could lead to the annual bill for a households using a typical amount of energy falling by £268 to £1,660.

However, this remains a forecast and international events could still have an impact on prices.

What can I do if I can’t afford my energy bill?

- Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

- Pay what you can: If you can’t meet your direct debit or quarterly payments, ask your supplier for an “able to pay plan” based on what you can afford.

- Claim what you are entitled to: Check you are claiming all the benefits you can. The independent MoneyHelper website has a useful guide.

Read more here

Related Topics

- Money

- Personal finance

- Energy industry

- Cost of living

- UK economy

-

Energy prices: How much will you pay from January?

-

24 November 2023

-

-

What can I do if I can’t pay my energy bill?

-

23 November 2023

-

-

What are cost-of-living payments and who gets them?

-

13 December 2023

-

-

Energy bills could rise to cover customers’ debts

-

15 December 2023

-

-

Ofgem warning after Grayson Perry energy bill saga

-

19 December 2023

-