Expectations that interest rates will be cut this year remain despite a surprise uptick in the UK’s inflation rate last month.

Inflation, which measures how prices rise over time, rose marginally to 4% in December, up from 3.9% in November.

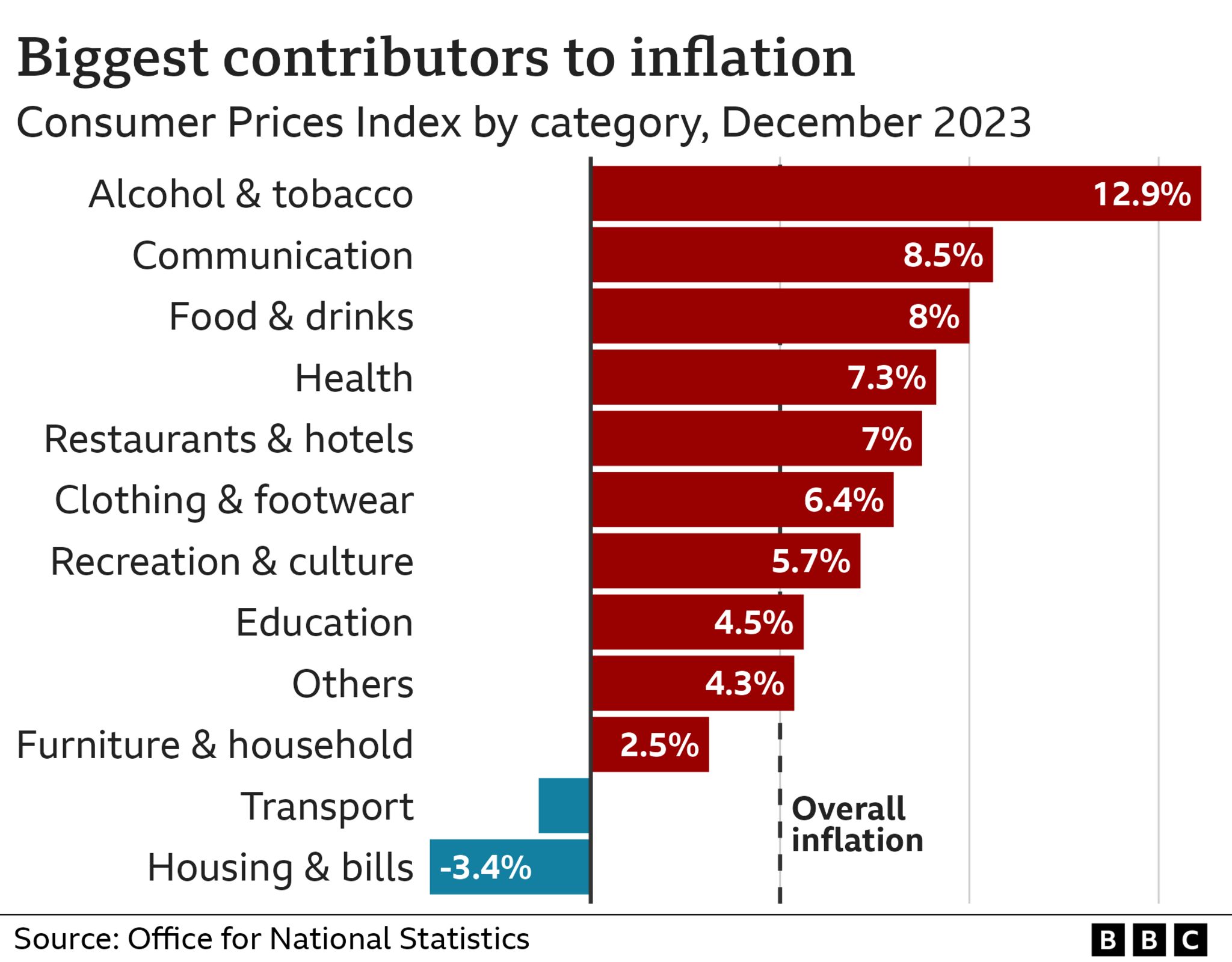

Economists had forecast a slight fall, but rises in tobacco and alcohol prices were behind the surprise rise.

But with energy bills predicted to come down in 2024, there are expectations of rate cuts later this year.

Spikes in the cost of gas and electricity and food costs, started by Covid lockdowns ending across the world and fuelled further by Russia’s invasion of Ukraine, have put household finances under pressure in recent times.

The Bank of England raised rates in a bid to tackle the pace of price rises in the UK, which has strained the finances of households.

The Bank’s rate currently stands at 5.25%, a 15-year high,which has led to higher mortgage rates due to the cost of borrowing money being more expensive. Returns on savings, however, have also gone up.

But financial markets and traders are now expecting it to cut its base rate in 2024 due to the inflation rate falling sharply since peaking at 11.1% in October 2022, which was the highest rate in 40 years.

Rate cuts ahead?

Inflation has also fallen quicker than the Bank had predicted, but it still remains nearly double its 2% target.

Ruth Gregory, deputy chief UK economist at Capital Economics, said she expected inflation to fall below the Bank’s 2% target in April, which would leave policymakers “in a position to cut interest rates by June”.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, agreed that energy prices falling further would drive down overall inflation, which he said should give the Bank “confidence” to cut its rate for the first time in May, “or failing that in June.

However, he warned that the five cuts priced in by investors to bring rates down to 4% this year looked a “stretch”.

- Follow live: Tobacco and alcohol fuel surprise inflation rise

- UK inflation rate calculator: How much are prices rising for you?

- How to save money even when the budget is tight

How is your mortgage being affected by interest rates? Get in touch.

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload your pictures or video

- Please read our terms & conditions and privacy policy

Sarah Coles, head of personal finance at Hargreaves Lansdown, said while the “trend is likely to be downwards” on interest rates, “there are likely to be more knocks on the way, with conflict in the Red Sea raising the risk of supply shortages, which could feed into higher prices”.

Several shipping companies have stopped vessels using the Red Sea – one of the world’s busiest shipping lanes – after attacks by Houthi rebels in Yemen.

Container vessels carrying all sorts of goods and fuel, mainly from Asia to Europe are having to divert around the southern tip of Africa, adding about 10 days onto journeys, which has prompted warnings that consumer prices could rise and drive up inflation again.

“There’s the risk this could end up throwing a real spanner in the works,” added Ms Coles, pointing out that December’s surprise rise in inflation “demonstrates that the path is going to be bumpy”.

Ahead of speculation of the Bank cutting interest rates, mortgage lenders have been announcing reductions in borrowing costs. On Wednesday, Coventry Building Society and Santander announced cuts as competition among lenders continues.

Grant Fitzner, chief economist at the Office or National Statistics (ONS), told the BBC’s Today programme that other countries including France, Germany and the US had also seen a “slight uptick” in annual inflation in December.

The ONS said tobacco and alcohol prices were up 12.9% in December compared to the month before, with the former rising due to recent tax hikes on the product.

Mr Fitzner said on a positive note, food price inflation had fallen “significantly” to 8%. Just because the rate is falling, however, it does not mean goods are getting cheaper, just that their prices are rising at a slower pace.

Gareth Jones, owner of family-run Singleton Jones delicatessen in Warrington Market, told the BBC price rises have been “tough for everybody” and that he has noticed his customers’ shopping habits have changed.

“You see it, instead of buying a pound of cheese, they’ll buy three quarters of a pound of cheese. You talk to them, and they’re all hoping the prices are going to start dropping, but I don’t see it at the moment. Not where the economy is going,” he said.

He said although his goods prices had “stabilised up to a point”, they were still at a higher level.

As well as tobacco and alcohol costs increasing, prices for recreational goods including DVDs, computer games, sports equipment, cat food, and theatre admissions also increased.

Chancellor Jeremy Hunt said while overall inflation had risen again, the government’s “plan is working and we should stick to it”.

“As we have seen in the US, France and Germany, inflation does not fall in a straight line,” he added.

But shadow chancellor Rachel Reeves said “any rise in inflation is bad news for families”.

“Prices are still rising in the shops, with the average weekly shop £110 more than it was before the last general election, and the average family set to be £1,200 worse off under Rishi Sunak’s tax plan,” she said.

Ways to save money on your mortgage

1. Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

2. Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

3. Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Read more here

Related Topics

- Economics

- Inflation

- Cost of living

- UK economy

-

What is the UK inflation rate and how does it affect me?

-

4 hours ago

-