Stronger retail sales helped the UK’s economy to rebound in November, but the risk of recession remains.

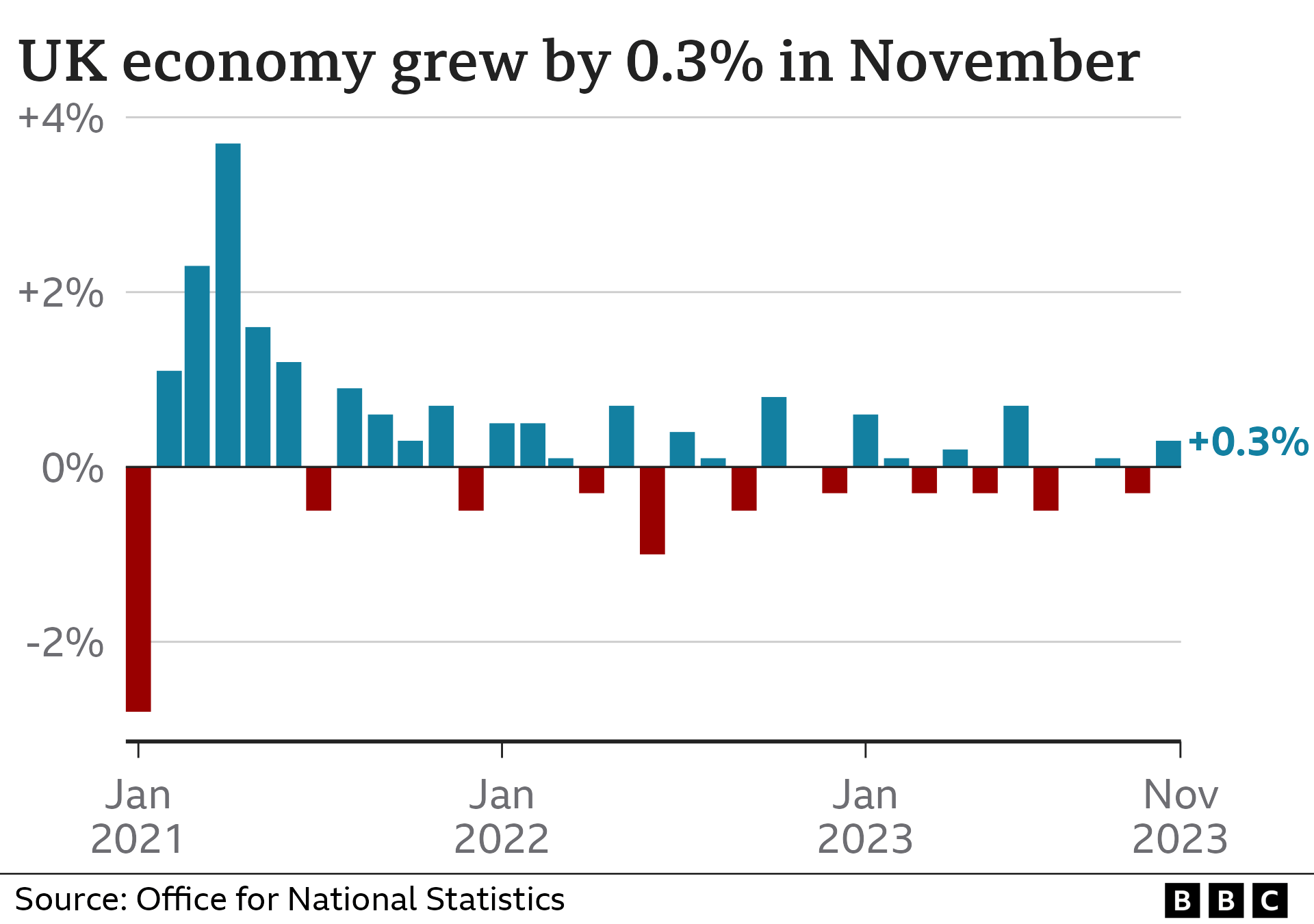

The economy grew by 0.3% in November, official figures show, after it shrank during the previous month.

The Office for National Statistics said the services sector led the rebound, as Black Friday sales boosted retailers.

But it said the economy had shown “little growth” over the past year and economists said it was a close call as to whether the UK can avoid a downturn.

Figures released last year showed the UK was at risk of a recession after the economy shrank between July and September.

A recession is typically defined as when the economy shrinks for two three-month periods – or quarters – in a row. The UK economy will meet this criteria if it contracts between October and December.

Grant Fitzner, chief economist at the ONS, told the BBC that November’s rebound was driven by “strong retail sales but also car leasing, computer games and fewer strikes than we’ve seen in previous months”.

“We have had quite a number of companies telling us they saw strong Black Friday sales which had a positive impact not just on the retail sector but also warehousing, couriers and some manufacturing sectors.”

However, while monthly growth was stronger than expected, the UK economy is in a fragile state and the ONS figures showed that in the three months to November, the economy shrank by 0.2%.

For the government’s pledge to grow the economy by the end of 2023 to be met, there will have to be a further expansion of activity between November and December.

Economic growth is a seen as a good thing for most people because companies become more profitable, more jobs tend to be created and firms can pay employees more money.

But when growth is stagnant, or a country is in recession, people tend to feel worse off and unemployment can rise as companies cut back on spending.

Economists predict it will be touch-and-go as to whether the UK can avoid a recession.

Are you affected by the issues raised in this story? Get in touch.

- Email haveyoursay@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload your pictures or video

- Please read our terms & conditions and privacy policy

Ruth Gregory, deputy chief UK economist at Capital Economics, said November’s rebound “probably means the economy escaped a recession in 2023”, but expects zero growth for the final three months of the year.

Growth prospects for 2024 remain uncertain.

Wage growth on average is outpacing inflation but more than a million households face being exposed to higher interest repayments in the coming months as they re-fix mortgages. Businesses that rely on healthy consumer spending are paying the price, with consumer-facing services still over 5% smaller than before the pandemic.

- What is a recession and how could it affect me?

- What is GDP and how does it affect me?

Samuel Tombs at Pantheon Macroeconomics said it is a “coin toss” as to whether the UK avoided a recession at the end of last year.

But he added: “With employment still rising and business and consumer confidence recovering, it would be overblown to label this a recession if GDP did indeed drop slightly”.

The ONS’s Mr Fitzner said: “I think it is important to remember that a recession is not just a very small negative number followed by a very small negative number. It is a significant and sustained fall in output. We don’t expect to see that.”

Responding to the latest growth figures, Chancellor Jeremy Hunt said: “While growth in November is welcome news, it will be slower as we bring inflation back to its 2% target.”

The Bank of England has, until relatively recently, been raising interest rates to cool inflation, which measures the pace at which prices are rising.

While higher interest rates can control inflation, they can also dampen economic growth.

Inflation has slowed to 3.9% in the year to November. While that remains higher that the Bank’s 2% target, calls for interest rate cuts from some are intensifying.

However, Bank of England governor Andrew Bailey has repeatedly said it is too early speculate about possible cuts.

Another source of uncertainty for the economy is the potential impact of the continuing attacks on shipping in the Red Sea by Houthi rebels.

The attacks – which have now led to air strikes by the US and UK – mean many of the world’s major shipping firms have been avoiding the key route for global trade.

However, the alternative route, around Africa’s Cape of Good Hope, adds about 3,500 nautical miles to the journey, making trips longer and more expensive.

Companies such as Next and Ikea have said they are expecting delays in receiving their goods. And if the cost of shipping products to the UK increases, companies may choose to pass it on to customers through higher prices, which could add to inflation.

Oil prices also rose on Thursday after Iran seized a tanker off the coast of Oman. The oil tanker was heading for Turkey when armed men ordered it to sail to an Iranian port.

The BBC understands the Treasury has modelled scenarios including crude oil prices rising by more than $10 a barrel and a 25% increase in natural gas. A rise in oil and gas prices risks fuelling inflation.

The government is concerned that if attacks on shipping in the Red Sea continue, the UK economy could shrink further if the disruption affects tanker traffic more widely.

Related Topics

- GDP

- UK economy

- Office for National Statistics

-

UK at risk of recession after economy shrinks

-

22 December 2023

-

-

Too early for rate cut speculation, says Bank boss

-

14 December 2023

-