The ex-boss of NatWest, Dame Alison Rose, will lose out on £7.6m after she admitted to discussing the closure of Nigel Farage’s bank account.

Dame Alison will receive her £2.4m fixed pay package, but will not benefit from share awards and bonuses she had previously been entitled to.

Dame Alison resigned in July after she spoke about Mr Farage’s bank account with Coutts, which is owned by NatWest.

The former chief executive said she accepted the bank’s decision.

“I am pleased that NatWest Group has confirmed that no findings of misconduct have been made against me,” Dame Alison said in a statement, adding that the settlement had brought “the matter to a close”.

In its announcement of her pay deal, however, NatWest said Dame Alison had not been given “good leaver” status.

If she had, Dame Alison would have been entitled to receive the entire amount which, after including her yearly salary, would have exceeded £10m.

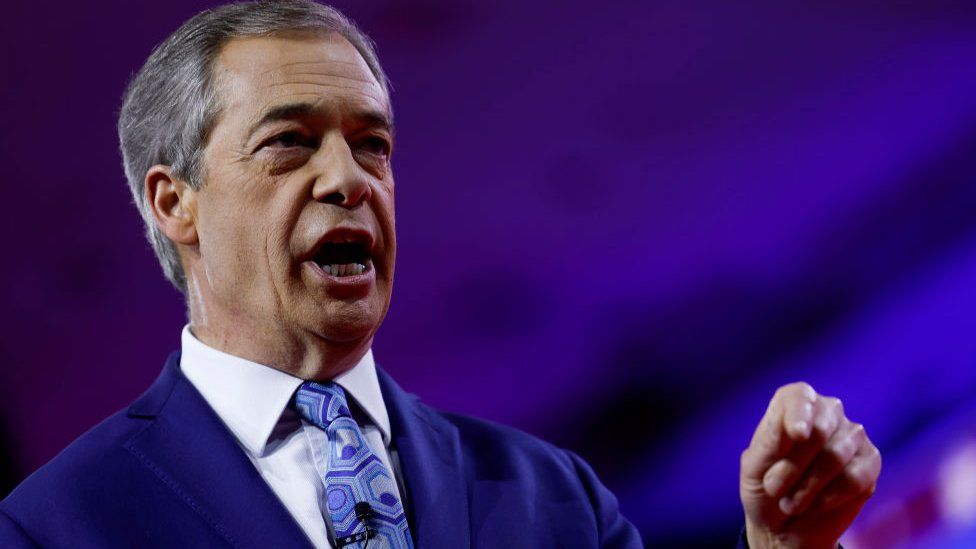

Mr Farage said the decision by the bank, which is 39%-owned by the government, was “correct and right”.

“She will still walk away though with about two and a half million pounds, so please don’t feel too sorry for her,” he added in a video posted on X, formerly Twitter.

But Mr Farage said this was “not the end of the NatWest saga” and that he had instructed lawyers to take action against the bank “for what they have done” and aimed to turn this into a class action.

- The bank boss brought down by the Nigel Farage row

- NatWest hit by profit fears as it admits Farage failings

Last month, NatWest admitted to “serious failings” in its treatment of former UKIP leader, Mr Farage, after an independent report found it failed to communicate its decision properly when it decided to shut his Coutts account.

Mr Farage, a prominent Brexiteer, said earlier this year that he had been told Coutts, the prestigious private bank for the wealthy, was closing his account but he had not been given a reason.

The BBC reported that his account was being closed because he no longer met the wealth threshold for Coutts, citing a source familiar with the matter.

Mr Farage later obtained a report from the bank which indicated his political views were also considered.

In the aftermath, Dame Alison, who was then the most powerful woman in UK banking, resigned after admitting she had made a mistake in speaking about Mr Farage’s relationship with the bank.

The fallout also sparked a public debate over people having their bank accounts shut due to their views.

An independent review into the closure of Mr Farage’s account found that it was lawful and based mainly on commercial reasons.

But it found other factors were considered including Coutts’ reputation with customers, staff and investors due to Mr Farage’s public statements on issues such as the environment, race, gender and migration.

Mr Farage branded the review a “whitewash” and accused Travers Smith, the law firm conducting it, of taking “mealy-mouthed” approach to the investigation.

Earlier this week, the UK data watchdog apologised to Dame Alison for suggesting she had breached privacy laws following its own probe into the closure of Mr Farage’s bank account.

The Information Commissioner’s Office said its comments in October suggested it had been investigating Dame Alison when, in fact, its probe was into NatWest’s actions as a data controller.

Despite quitting, Dame Alison was always in line to receive her £2.4m pay package for 2023 under the terms of her contract, but NatWest previously said it could claw back her bonus and share awards.

The bank confirmed on Friday that Dame Alison would continue to receive the rest of her salary, worth £1.75m, over the remainder of her 12-month notice period as well as some shares worth £800,000.

But NatWest said its former boss would not receive share awards worth £4.7m and that she would forgo her bonus and variable remuneration for 2023, which would have been £2.9m.

NatWest added that it would pay a maximum of £395,000 plus tax towards Dame Alison’s legal fees under the settlement.

Related Topics

- UK banking

- Companies

- Nigel Farage

- NatWest Group

- Banking

-

Watchdog apologises to ex-bank boss in Farage probe

-

4 days ago

-

-

NatWest hit by profit fears as it admits Farage failings

-

27 October

-

-

Watchdog: Ex-NatWest boss breached Farage privacy

-

25 October

-

-

NatWest boss quits after Farage bank account row

-

26 July

-